Automated Trading

Updated on 2023-08-29T12:00:44.468322Z

What is Automated trading?

Automated trading refers to the buying and selling of financial assets or instruments by using technological methods such as a computer program that perform pre-set rules of trading for both entering and exiting trades. Automated trading is also termed as algorithmic trading, automated trading system, and mechanical trading systems.

Copyright © 2021 Kalkine Media Pty Ltd

Understanding Automated Trading Rules

Automated trading helps in participating in trading process of financial markets. Auto trading allows an individual to do as many trades as possible in a short time frame. Automated trading is an electronic trading system which is automatically executed with the programed rules and parameters of trading. With the help of algorithms, traders can use their strategies to follow and monitor trends and trades.

For automatic trade, many platforms allow traders to select a set of rules as per their strategy by using the wizards that include a list of technical indicators. It allows choosing entry, exit, and other rules into algorithm systems in order to perform and monitor the trades.

FAQs

What are the advantages of automated trading?

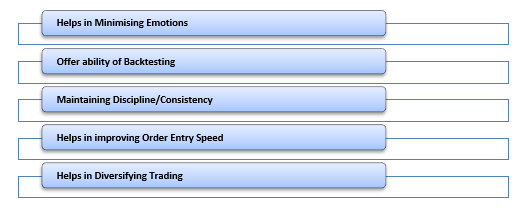

There are several advantages of automated trading are as follow:

Copyright © 2021 Kalkine Media Pty Ltd

- Helps in Minimising Emotions: In trading process, emotions of an investor can be a hurdle. Automated trading helps in avoiding these barriers all over the trading process. Automated trading system can clear all the doubts or questions of an investor or a trader since trade orders can be performed automatically after the trade rules have been met investor’s strategy criteria, which he/she pre-determined for the trading.

- Offer ability of Backtesting: In automated trading, backtesting plays a vital role as it helps to understand how a strategy or model would have given actual return. Backtesting evaluate the growth of a buying and selling strategy, by determining how it would work using historical data. When a system is programmed for automated trading, all rules should be absolute without any loop hole. Backtesting allows traders or investors apply trading rules to historical market data to discover the growth/return of trading idea.

- Maintaining Discipline/Consistency: Because of automated trading, buying and selling of financial assets is executed automatically, discipline is maintained even in unstable markets. Fear of loss or desire of gaining more profit cause inconsistency. Automated trading helps us to make sure consistency because the trading idea will be followed automatically. It controls the emotions of investors or traders which leads the consistency in trades.

- Helps in improving Order Entry Speed: Financial markets can move fast, taking entry or exit a few seconds late or earlier can make a huge difference in the trade’s return. As automated systems, computers respond directly to market changes, and are able to take orders right after programmed trading criteria are met. Automated trading responded to the trades which lie fully in the criteria of investors or traders which they set or programmed.

- Helps in Diversifying Trading: By diversifying trading, investors or traders reduce the risk or the chances of their loss. Automated trading systems allow traders to buy and sell various accounts at one time. By investing in different instruments, traders allocate risk and ensure positive return. With the help of automated trading, traders or investors are able to analyze trading opportunities in markets which fix into their rules and trade criteria, generate orders and monitor trades.

What are the disadvantages of Automated trading?

There are so many advantages of automated trading, but there are some drawbacks too. It includes:

Copyright © 2021 Kalkine Media Pty Ltd

- Technology Failures: In order to perform trading by using automated trading system, we need internet connectivity. Automated trading seems easy and simple, like setting up the software and the rules. But in reality, it is not simple. Traders can depend and trust a computer, not a server. Any disruption due to poor internet connection, can obstruct the generation of an order.

- Monitoring of functionality : Automated trading systems require close monitoring, we can’t just open a computer and leave it in between because of technology faults can happen at any time such as power cuts, connectivity issues, or computer crashes, etc. It could be the reason of missing or duplicating orders, and errant orders. In order to avoid these problems, traders have to monitor the computer system. Traders can prevent them from a loss by monitoring which may occur due to connectivity or any other issue.

- Over-Optimisation: Sometime things seem easier on paper but performing them in reality can be terrible. These are related to the backtesting techniques performed by the traders in order to know the result of their trade idea based on historical market data. Many times when traders engage backtesting techniques that generate a system which look good on paper, it might not work in real time at the implementation in live market. Here over-optimisation means over assumptions that generate a trading plan which is inaccurate in live trading.

What do you need to start Automated trading?

Automated trading is based on a pre-set of rules that helps an investor or trader to buy and sell financial commodities by using computer program, it will perform trade orders depends on pre-set of rules and submit to market exchange automatically. These pre-sets of rules may define by using different strategies such as statistical and technical analyse, mathematical and other inputs from various sources.

In order to start automated trading, the basis hurdle for an investor or a trader is to implementing the trading strategy into a computerized process from which trading order takes place. Requirements for staring automated trading are as follow:

- Programming knowledge: The investors or traders must have computer programming knowledge to program the identified trading strategy. They can also hire programmers, or purchase trading software.

- Connectivity: For performing trade orders, access of internet connectivity to trading platforms is mandatory.

- Market Information: The algorithm identifies opportunities by monitoring market data feeds to place orders.