Back-end Ratio

Updated on 2023-08-29T11:55:13.761288Z

What is the back-end ratio?

The back-end ratio is a ratio that signifies the part of the monthly income utilized for debt settlements. The ratio is employed by lenders such as issuers of mortgages and bondholders to ascertain the borrower’s ability to pay off the money. Chiefly, the ratio is used for assessing the borrower’s risks. Another term for the back-end ratio is debt-to-income ratio.

If the back-end ratio’s value is high, then it is interpreted that the borrower utilizes a large sum of their monthly income for the purpose of debt settlement and a high amount of risk is associated with the borrower. Similarly, if the value of the back-end ratio is low, then the borrower will be considered a low-risk borrower. The back-end ratio of a borrower should not exceed 36%. In rare cases, a 50% back-end ratio is also accepted, especially for those who have good credit.

Generally, the back-end ratio is used in conjunction with the front-end ratio which is used by lenders for the purpose of mortgage approval.

Summary

- The back-end ratio is a ratio that signifies the part of the monthly income utilized for debt settlements.

- The ratio is employed by lenders such as issuers of mortgages and bondholders to ascertain the borrower’s ability to pay off the money.

- Another term for the back-end ratio is debt-to-income ratio.

- The back-end ratio of a borrower should typically not exceed 36%.

Frequently Asked Questions (FAQs)

Why back-end ratio is used?

The back-end ratio is a metrics that is utilised by the mortgage underwriters to ascertain the level of risks before lending money to a borrower. It is a crucial component as it denotes the amount of the borrower’s income that is owed to another party or company. A high percentage of back-end ratio depicts that the borrower must pay a large sum of income to another company or party on monthly basis. Furthermore, it is assessed that job loss will result in a pile of unpaid bills or non-payment to the lender.

The ratio is important because it helps in evaluating the credit risk of borrowers. By combining it with the front-end ratios, lenders evaluate the financial obligation of the prospective borrowers in relation to their monthly income. A rule of thumb is used by the lenders, that a prospective borrower’s back-end ratio should not exceed 36%. However, in case the borrower has a good credit score, the ratio’s value is put to ease.

How back-end ratio is calculated?

To calculate the back-end ratio, all the monthly debt payments of the borrower are added and then divided by the monthly gross income of the borrower.

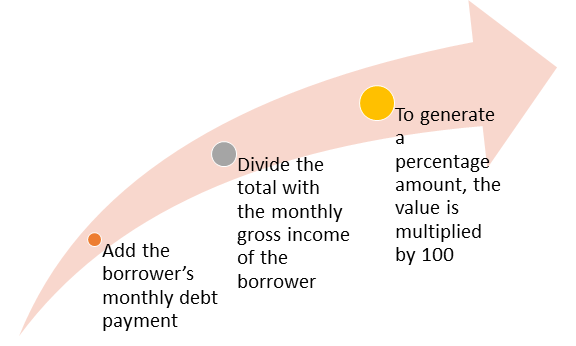

Steps for calculating the back-end ratio –

- Add the borrower’s monthly debt payment.

- Divide the total with the monthly gross income of the borrower.

- To generate a percentage amount, the value is multiplied by 100.

Generally, the following expenses are included in the debt payment –

- Mortgages

- Insurance

- Credit card bills

- Other loans

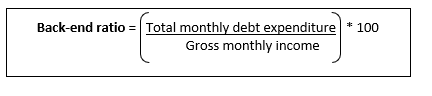

The back-end ratio formula is:

For example, the monthly income of a borrower is $10,000, and the borrower must make a total debt payment of $4,000 every month. Therefore, the back-end ratio is the 40%, that is, ($4,000 / $10,000)* 100. As per the rule of thumb, it is unlikely that the lender will lend money to the borrower with a 40% back-end ratio.

What is the procedure to improve the back-end ratio?

the back-end ratio can be reduced considerably by selling those assets, for instance a car, which is financed (on loan) or by paying off all credit cards. In case the borrowing is made for the purpose of refinancing, then the cash-out refinance can further reduce the back-end ratio. In the case of refinancing, the lender will bear higher risk, therefore, the interest on the loan will be higher in comparison to the standard loan.

What are the limitations of the back-end ratio?

The back-end ratio is only one of the metrics which is adopted by the lenders to assess the borrower’s ability to make debt payment or to fulfil debt obligations. The decision to extend credit can also be based on the credit history and the credit score of the borrower.

The range of debt and service costs associated with the debt is not recognised by the back-end ratio. To illustrate, both a student loan and a credit card are included in the total debt (numerator), however, a higher rate of interest is associated with the credit card in comparison to the student’s loan.

When the borrower transfers their credit card from low interest to a higher interest, in result the monthly payment will increase. However, the back-end ratio does not consider the change as the ratio considers the sum of all the debts.

What is the difference between the front-end ratio and the back-end ratio?

Front-end ratio – Mortgage to income ratio is another name for the front-end ratio. It is calculated by determining the monthly mortgage payment and then dividing it with the monthly gross income of the prospective borrower. In a mortgage, interest, principal, insurance amount and taxes are included. To illustrate, assume that the mortgage payment is AU$ 4,000 and the gross monthly income is AU$16,000. Here, the front-end ratio is 25%, and generally, it is the prescribed limit by the lenders.

The back-end ratio – Debt-to-income ratio is another name for the back-end ratio. The ratio analyses the current debt position of the tentative borrower and the ability to pay off the loan. To determine the affordability of the borrowers, previous personal loans, automobiles loans and credit card monthly payment are included while projecting the mortgage. To illustrate, a borrower’s monthly debt obligations are AU$140 and the gross income is AU$400, then the back-end ratio will be 35% and the accepted back-end ratio is up to 36% or below.

What is the 28/36 rule and how it affects the mortgage?

The 28/36 rule is used to ascertain the amount of debt a household should assume based on their lifestyle, debt, and other income. As per the 28/36 rule, a household should spend 28% of its monthly income for paying off household expenses. Moreover, 36% of the income should be spent on credit cards and car loans. This rule is used by lenders before extending loans to borrowers.

The rule is used by the consumers while planning their monthly budget and it improves their chances of getting credit. The parameter can be tweaked by the lenders, that is some lenders accept a lower percentage while others demand a higher percentage.