Brownfield Investment

Updated on 2023-08-29T11:58:04.941235Z

A Brownfield Investment refers to an investment made in an existing active project or even an inactive project with an existing developed facility or infrastructure. Such investment is made when an organization or a firm wants to expand its capacity using the existing infrastructure, thus entails fewer approvals as against a greenfield investment. The regulation requirements and high cost of starting new businesses make investments in brownfield projects highly lucrative.

For brownfield investment purpose, a company can enter into Merger and Acquisition (M&A) or can farm-in to invest in existing facilities or infrastructure. Brownfield investments are the safest way to invest in a new territory and to understand the market sentiments. A company or firm can invest in an existing business to learn and gain experience prior to going for its own greenfield projects.

The greenfield projects are capital intensive and always carry a risk of project failure. The brownfield projects, on the other hand, involves lower capital cost and have tested market segment.

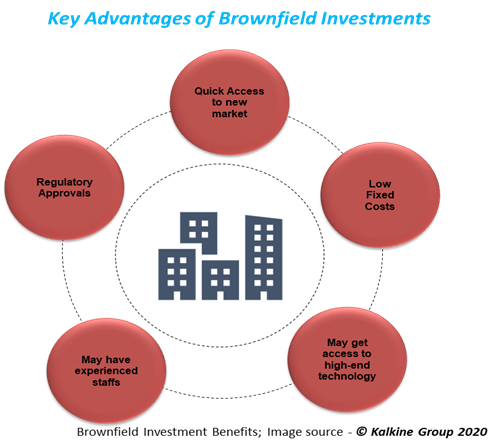

Benefits of Brownfield Investments

- Quick access to new market

Since the new entrant in the market need not invest a lot of time and money for a new facility or infrastructure, the company could enter and have access to the market really quick. Operations could be started from the existing setup or a little tuning as per the product specifications.

The existing firm may have a well-established channel of vendors and suppliers that could eliminate the risk of searching the dependable source of raw materials. The new company could use the existing distributor channel for taking a product to the market with the help of existing supply chain systems.

- Regulatory Approvals

Due to various environmental regulations and many countries trying to meet their respective carbon emission levels targets, getting regulatory approvals can be really a herculean task.

Apart from the environmental, there are many bureaucratic approvals required to set up any facility. In a brownfield project, it is a possibility that the existing facility may have already all approvals required for the project. It will save both time and money.

- Low Fixed Cost

The brownfield projects have required infrastructure which can be put to use immediately, eliminating the need for excessive capital. The facilities may require little modifications or tuning to get started.

Payment for regulatory approvals and fee for procurement of specific licenses are also not required. The existing facility may have all approvals and permits. Setting up new market networks and logistics may not be required as the existing facilities may have them all.

- Staffing and Training

It is also a possibility that the project or the facility may have existing well trained and experienced staff for the project. The company need not have to hire fresh staffs and bear training and inductions expenses.

- Access to high-end technology

The M&A or takeover of existing high-end technology firm can help gain access to the technology which may be expensive to develop group up. One such example is the acquisition of Jaguar Land Rover Limited by Tata Motors.

The acquisition helped Tata Motors to take over the working facility of the Jaguar Land Rover. Tata Motors gained access to high-end technology of luxury cars along with the well-equipped facility to manufacture those cars.

Some of the recent brownfield investments are:

- Acquisition of Cray by Hewlett-Packard Enterprise in 2019. Cray was a leading innovative technology company working in the field of Artificial Intelligence (AI) and was designed to manage massive data centres and simulation using supercomputing technology.

HP acquired Cray for US$ 1.3 billion in order to make inroads into the world of supercomputing. The acquisition could enable HP to perform better in the digital environment.

- Acquisition by Walt Disney in 2006 of Pixar. Pixar Animation was a computer animation studio that made the first-ever computer-animated feature film- Toy Story in 1995. Walt Disney acquired Pixar in a deal worth US$ 7.4 billion.

The acquisition allowed Walt Disney to get more advanced technology for animated movies and at the same time removed competition also.

- Acquisition of Jaguar Land Rover (JLR) by Tata Motors in 2008. Tata Motors acquired JLR from Ford for a sum of US$ 2.3 billion. Tata Motors got working automobile plants in England along with the ownership of the good brands.

Tata Motors also got commitments from the dealers who were eager to work with the JLR brand and were incurring losses at the time of acquisition. Tata Motors was once World’s largest manufacturer of buses and trucks. They had a stronghold in the Indian car market but did not have experience and technology in high-end luxury cars.

Brownfield investments have some drawbacks which can be listed as below.

- The existing facility may require a major facelift, which can increase the investment cost.

- The machinery and equipment may be obsolete, and replacement would be required.

- High maintenance of infrastructure and equipment due to usage over the period will increase the operational cost.

- Risk of change in regulatory requirements and tax policy is always there.

- The existing facility may have hazardous or contaminated material which may require clean-up cost will be borne by the new investor.