Business Risk

Updated on 2023-08-29T11:57:01.491576Z

What Is Business Risk?

A threat to a company's ability to meet its objectives is referred to as a business risk. Risk in business refers to the possibility that a company's or organisation's plans will not work out as expected, that it will miss its target, or that it will fail to reach its objectives.

In simple terms, business risk refers to the possibility of incurring losses or earning less profit than expected. These variables are beyond the control of businessmen, and they can result in a decrease in profit or even a loss. Business risk refers to the possibility that a company's earnings will be smaller than expected or that it will lose money instead of making a profit. Several factors affect business risks, such as sales volume, per-unit price, production costs, competition, the overall economic environment, and government regulations.

Summary

- A threat to a company's ability to meet its objectives is referred to as a business risk.

- Business Risk's nature may be strategic, financial, operational or compliance-based.

- Several factors affect business risk, such as production costs, competition, the overall economic environment, government regulations, internal management issues, natural disasters etc.

FREQUENTLY ASKED QUESTIONS

What Are The Types Of Business Risk?

Depending on the nature of the causes and results, business risks may be classified as follows-

Copyright © 2021 Kalkine Media

At any point in time, strategic risks may arise. Companies must incorporate a real-time feedback system to know what their consumers want to deal with such threats. Strategic risks include mergers, pressure from shareholders or creditors, the pressure of competition with rivals, changes in demand, changes in rules and regulations by the government, backfiring of a project or innovation, political instability and sullied reputation. Social distancing norms and lockdowns badly affected the dine-in options in restaurants, and they were confined to home deliveries.

The financial health of the company is the subject of financial risk. Factors that adversely impact the financial growth and profitability of a firm are called financial risk. Financial risk may include excess debt, mismanagement of cash flow, and change in how bad debt reserves are estimated. Financial risks may also arise due to fluctuation in market interest rates and exchange rate.

Operational risk is a type of risk that exists within a company's system or processes or even people. While strategic risk is to do with doing what is right, operational risk is about doing things in the right way. A company's functionality is impacted by operational risks like fire, crimes, natural disasters, cybersecurity failure, embezzlement, theft, labour strike. An example of operational risk is when many employees get affected by the covid 19 pandemic at the same time.

Companies may face compliance risk if they are required to follow new rules established by the government or a regulatory body. Tax evasion, bypassing environmental laws, violation of labour laws, financial irregularities, irregularities in worker safety infrastructure, inadequate measures for women’s safety, child labour are all compliance risk factors. A classic example of compliance risk is that of Lehman Brothers.

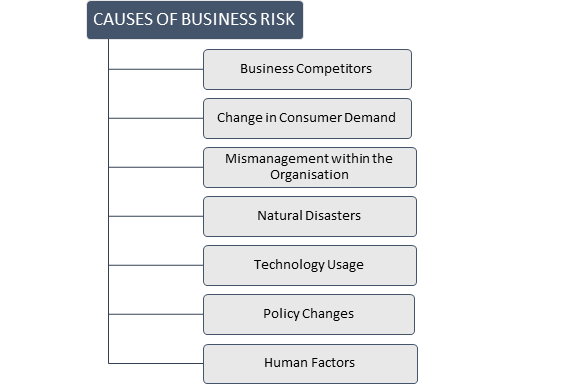

What Are The Causes Of Business Risk?

The following are the possible causes of business risk:

Copyright © 2021 Kalkine Media

Business Competitors - When a company faces strong rivals in the market, the manufacturers engage in cutthroat competition by lowering the price of goods or manufacturing lower-quality products; this poses a significant risk to the company.

Changes in the product's demand - A sudden shift in demand for a particular product can pose a business risk.

Incompetent Mismanagement - Management is often incapable of running the company, which is a significant source of business risk. They were unable to achieve the expected goals due to poor planning or planned, which increased the risk. All of this will result in a decrease in cash flow and an increase in per-unit costs.

Natural disasters - Natural disasters, such as floods and earthquakes, may cause significant damage to a company. Since nature is uncontrollable for humans, any damage caused by natural disasters is inevitable and uncontrollable.

Technology Usage - If a company is financially stable, it can invest in heavy machinery and new manufacturing techniques. This stability reduces the per-unit cost of the output of products. However, procuring these technologies may add more financial burden and may affect the business adversely.

Policy Changes - For businesses, government policies are inevitable. A sudden shift in the government's monetary and fiscal policies unfavourable to business would result in a loss.

Human Factors

Theft, forgery, extravagant spending, and top-heavy management can all result in business losses.

How Can Business Risk Be Mitigated?

Many risks exist in a business, but they can be mitigated by taking certain precautions. Management may use strategies to reduce the chances of certain occurrences happening, resulting in a loss. All threats cannot be eliminated, but they can be reduced. As a result, strategies that minimise loss are implemented.

Risk Management Word CloudID 29477440 © Moth | Megapixl.com

When identifying business goals, many businesses fail to consider or accept risk. It is critical to define the types of risks that could endanger the company at this stage. This risk analysis can be accomplished by an essential exercise such as SWOT analysis. Key performance indicators (KPIs) are a way to track progress and identify problems. Identifying risks impact KPIs and results. Making a comprehensive list of potential risks is essential so that if something goes wrong with the company, it can quickly be identified and fixed. When setting the risk tolerance thresholds, reliance on an automated tool for alerts and notifications can also help manage risk.

What Is an Example of Business Risk?

Kodak was established in 1892 as a trademark for a camera that the general public could use. Kodak was a leading manufacturer of non-digital cameras and video recorders and a variety of film products. When digital cameras replaced old-style cameras on the market, the demand for film items decreased. For decades, the Kodak management refused to acknowledge digital photography as a revolutionary technology that would prove disruptive.

One of the high-impact threats for Kodak in the pre-digital age was that new technology would reduce demand for one of the company's film-based products. From commercial film cameras to digital x-rays to digital movie-making, this trend impacted almost every market segment Kodak worked in. This risk was not well mitigated and became the reason for Kodak’s downturn.