Capital Structure

Updated on 2023-08-29T11:56:42.987929Z

What is capital structure?

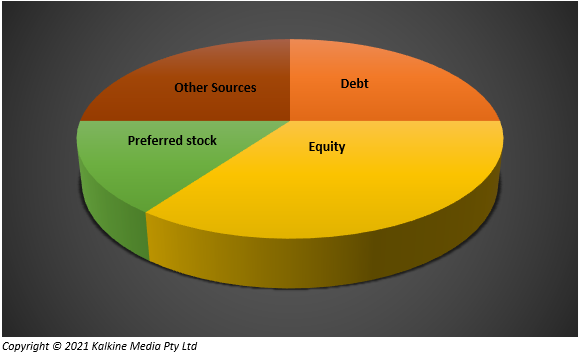

The capital structure of a Company tells us about the blend of debt and equity used to fund the business’s complete operations and growth. Companies use a different combination of capital raising methods to finance their operations, capital expenses, acquisitions, and other investments.

Debt is the money a Company borrows. In return, the Company has to pay interest to the lender within a defined timeline. The Company borrows capital via bonds or through bank loans.

On the other hand, equity comprises of ownership rights in a Company. The equity holder can claim a share in future cash flows and profits. Equity comes in the form of preferred stocks, common stocks or retained earnings.

While considering the capital structure of a Company, we look into short-term debt, long-term debt, preferred stock, and common stock.

When an analyst studies a Company's capital structure, he/she looks into its debt-to-equity ratio. The ratio helps the analyst understand the risks associated with the Company's borrowing practices. In case a company has a debt-to-equity ratio of more than 1, it means it is funded more through debt. The higher the value of the ratio, the higher is the risk exposure.

What are the different types of capital structure?

There are four kinds of capital structure:

- Horizontal capital structure

- Vertical capital structure

- Pyramid-shaped capital structure

- Inverted capital structure

Horizontal capital structure

In a horizontal capital structure, the firm’s capital structure has no debt component. This is one of the most balanced forms of capital structure is. Firms with horizontal capital structure expand using the capital raised via equity or retained earnings. Besides, there is a limited possibility of any disruption in the structure.

Vertical capital structure

In a vertical capital structure, the base is formed from a small portion of equity share. The base is the foundation on which the super structure of preference share capital as well as debt is developed. Any increase in the capital is majorly through debt.

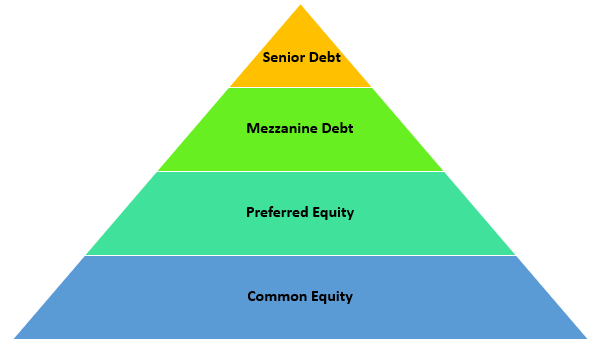

Pyramid-shaped capital structure

In a pyramid-shaped capital structure, the bottom-most layer comprises common equity. Above that is preferred equity. The top two layers include senior debt and Mezzanine debt.

Pyramid-shaped capital structure (Copyright © 2021 Kalkine Media Pty Ltd.)

Risk-averse conservative companies follow this structure.

Inverted capital structure

An inverted capital structure is the opposite of a pyramid-shaped capital structure. In this case, there is a tiny portion of the equity capital, an adequate level of retained earnings and an escalating debt element.

What factors influence a Company’s capital structure decision?

The capital structure decision of a Company depends on both external and internal.

Internal factors include financial leverage, risk, growth, and stability, cost of capital, retaining control, flexibility, cash flows, the purpose of finance and asset structure.

External factors influencing the capital structure decision include the Company's size, nature of the industry, investors, cost of floatation, legal requirements, duration of finance, level of interest rate, level of business activity, accessibility of funds, tax policy and level of stock prices.

Additional external factors include control of management over the firm, risk, income, tax consideration, trading on equity, investors’ attitude, flexibility, timing, legal provisions, profitability, growth rate, government policy, marketability, company size, flexibility and financing reasons.

How do companies decide which financial principle to select?

As companies grow with time, they keep track of how to fund their projects and operations, pay their employees, and keep the business ongoing. For this, companies look for the best mix of equity sold to investors and bonds sold to creditors.

Generally, companies look at three approaches to decide their capital structure. These include the net income approach, static trade-off theory and pecking order theory. Let’s understand these approaches.

Net Income Approach

In this style of capital structure, cost of capital is the function of the capital structure. The approach assumes optimum capital structure, indicating that at a certain debt-equity ratio, the cost of capital is at the lowest, and the value of the firm is highest.

Static Trade-Off Theory

Static trade-off theory is a financial theory designed by economists Modigliani and Miller. The two studied the capital structure theory and developed the capital structure irrelevance proposition.

The theory starts from capital structure irrelevance theory. It eliminates the assumption that there are no costs to financial distress when businesses borrow additional money. If the assumption is eliminated, then taking more debt would not reduce the Weighted Average Cost of Capital (WACC). Instead, there would be a specific point at which the value-reducing cost of financial distress exceeds additional value added by including one or more debt forms.

Pecking Order Theory

As per the Pecking Order Theory, a Company initially tries to fund itself through retained earnings. In case the Company does not have retained earnings to finance itself, then, in that case, it should go for debt. Finally, if nothing works out, then the Company should fund itself by using its new shares.

The Pecking Order Theory is essential as it highlights a Company's financial position and its performance. In case the Company is financing itself internally, it means it is doing well and is a strong company. Further, if the Company is financing through debt, it shows its confidence to repay the loan within the stipulated time. However, if the financing is done through equity, it gives a negative signal that the Company believes its stock is overvalued and aims to make money before any drop in its share price.