Debenture

Updated on 2023-08-29T11:56:41.832677Z

What are Debentures?

A debenture is an instrument through which an organisation raises loan from the market by issuing some certificates with the organisation’s seal and is known as Debenture Deed. Debentures are issued, just like equity shares, either through a private placement or offering to the public. Large companies generally raise fund through debentures without diluting the equity of the company.

When a company raises fund through debentures, the risk perception of equity shareholders increases as the debenture holders will be entitled to some fixed interest. To maintain a balance between the equity and debenture holders, the company has to increase the dividend payout ratio to the equity shareholders.

A company may issue debentures with an option to convert them into equity shares, either wholly or partly at the time of redemption only after the approval by a special resolution passed at a general meeting. The debentures with an option to convert into equity do not carry any voting rights.

Based on the nature of issuance and redemption of debenture, it can be issued with five possibilities.

- Debentures issued at parity and redeemable at parity.

- Debentures issued at a premium and redeemable at parity.

- Debentures issued at a discount and redeemable at parity.

- Debentures issued at parity and redeemed at a premium.

- Debentures issued at a discount and redeemed at a premium.

Debentures are issued with a fixed rate of interest, and the interest amount is paid either yearly or half-yearly basis. The interest payable is a charge against the profits of the company, and like other debts, has to be paid in case of losses too.

What are the different types of debentures?

- Redeemable and Irredeemable Debentures

As the name suggests, Redeemable debentures are issued for a specified period, after which the company must repay the amount on a specified date.

Irredeemable debentures are those who have no specified fixed date for repayments. The debenture holders cannot ask for the payment as long as the company is operational and does not default on interest payment. They are perpetual in nature and are paid back usually when the company goes into liquidation. Companies normally issue redeemable debentures.

- Registered and Bearer Debentures

Registered debentures are registered in the name of the holder. Registered debentures are transferable in the same fashion as shares are transferred through transfer deeds. Interest is paid to the person whose name is registered in the register of debenture holders.

Bearer debentures are unregistered and unsecured bonds. The company does not maintain any record for the holders. Usually, a coupon is attached to the debenture certificate for the purpose of interest payment.

- Secured and Unsecured Debentures

Secured debentures are also known as Mortgaged debentures. They are secured either by a mortgage of a particular asset of the company known as Fixed Charge or by the mortgage of general assets known as Floating Charge.

Whereas, Unsecured debentures are not secured by any charge or mortgage on any property of the company. Also known as 'Naked Debentures', companies with a good track record and strong financial standing can issue such debentures.

- Convertible and Non-convertible Debentures

Convertible debentures provide an opportunity to the debenture holders with an option to exchange a part or whole of the debenture amount into equity shares of the company on the expiry of the debenture period.

When only a part of the debenture amount is convertible into equity shares, it is known as 'Partly Convertible Debentures'. The debentures whose full amount is convertible into equity shares are known as 'Fully Convertible Debentures'.

As the name suggests, Non-convertible debentures, are those where holders do not have any option to convert them into equity shares.

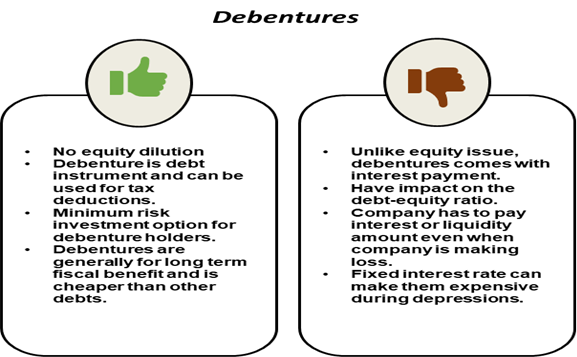

Image source - © Kalkine Group 2020

Investors try to maximise their return as high as possible. There are investors who have a higher risk appetite and invest in a high-risk portfolio. Debentures do not provide comparatively high returns on investments but provide a fixed and minimum risk-return.

Investors with a low-risk appetite as that of a younger person should think of debenture as an investment tool having fixed income and minimum risks.