Leverage Ratio

Updated on 2023-08-29T11:56:14.021974Z

What is Leverage Ratio?

Leverage Ratio is a quantitative measure indicative of the proportion of the business capital represented by debt. In other words, it highlights the extent to which a firm uses debts rather than equity for financing its operations. The leverage ratio is used for gauging the risk surrounding investment and evaluating if the company is able uphold its financial commitment.

The leverage ratio also pinpoints the degree of backing provided by the equity capital to the debts of the company. Significantly, the leverage ratio varies with respect to the industry and company types. For example, in the airline industry, banking institutions, capital goods businesses, have substantially higher leverage ratio. Furthermore, the startups also have a high leverage ratio

Good read: Understanding Types Of Leverage Ratios

What is the Concept of Leverage?

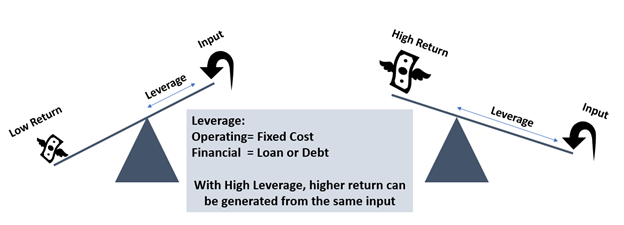

The term ‘leverage’ is generally used in relation to the investment strategy that uses loans or debt for financing its assets and overall increasing the return potential. At the same time, this strategy also increases the downside risk and makes the investment risky. This type of leverage represents financial leverage.

The total leverage can be broken down into Operating Leverage and Financial Leverage. In simpler terms, the cost structure of the operations is responsible for operating leverage, while the capital structure of the company accounts for financial leverage.

Notably, a high fixed cost leads to high operating leverage, and the high debt-level in the company’s capital structure denotes high financial leverage.

Kalkine Image

The use of leverage within the business can maximise both gains and losses.

Why is Leverage Ratio Important?

Businesses at a certain point borrow funds by issuing bonds or taking loans from banks, in cases when

- They do not possess substantial funds that are needed for pursuing operations or expansions

- They want to leverage borrowings for increasing return potential

The objective of borrowing loan and debt is to maximise the wealth via investment. However, in case of investment failure, the business faces twofold challenges which include loss of the original investment and additional interests burden that must be paid to the lender. Thus, the objective of wealth maximisation is only attained if the return on investment is higher than the interest or cost of the debt capital.

Good read: What Is Return On Invested Capital (ROIC)?

Concurrently, in case of investment failure, the lenders are also exposed to default risk, with the borrower unable to pay the principal or interest on the loan amount. In order to evade default scenario, the creditors evaluate the financial aptitude of the company using the leverage ratio.

Watch: What are Interest Rates?

Also watch: What are the Key Determinants of Interest Rates?

Leverage ratio indicating a significantly very high proportion of debt can be a dangerous sign for both the investors as well as the company as it indicates chances of credit downgrades and bankruptcy. However, a very low leverage ratio may point towards a conservative approach taken by the management, typically, at the cost of growth. The leverage ratio sheds light on how the variability in the output could impact the company’s income.

Leverage ratio is utilised not only by the management and the creditors, but the credit rating agency also use it for assessing the company’s overall health, its ability to fulfil obligations and analyse its future potential in terms of running a business and expanding.

Must read: Role of rating agencies and their impact on your investments

What are the Types of Leverage Ratio?

Common Leverage Ratios

- Debt-to-Equity Ratio

The ratio gives the measure of the total business’ obligations with respect to the shareholder’s equity. The ratio indicates the extent of dependency of the company on the

debt capital for pursuing its undertakings. Creditors and investors use the ratio for analysing the credit worthiness of the loan or debt.

High D/E ratio highlights that owners with limited capital investment can retain a significantly higher degree of control on the business. However, it potentially limits further borrowing opportunities.

Total Debts represent debentures and long-term loans. Total Equity is the combination of shareholder’ Equity, Reserves and surplus and Retained Profits.

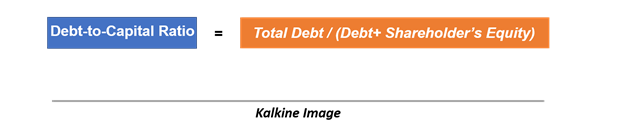

- Debt-to-Capital Ratio

The ratio indicates the degree of financial leveraging used in financing the business operations by comparing its total obligations against the total capital.

The ratio is calculated by dividing the Debt of the Company by the total capital, which represents the sum of the shareholder’s equity and total debt.

High debt-to-capital ratio signifies the risky nature of the business. Nevertheless, it should be noted that the value of the ratio varies with respect to the industry and also if the company is new or old.

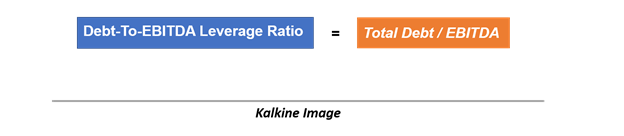

- Debt-To-EBITDA Leverage Ratio

The ratio compares the financial borrowings of the company against the Earnings before Interest, Taxes, Depreciation and Amortisation (EBITDA). The ratio indicates the company’s ability to pay its debts by utilising the income generated from its operations.

Total debt in the formula represents both long term and short-term debts.

EBITDA= Net Income+ Interest Expenses+ Tax Paid+ Depreciation/Amortisation

- Debt to Assets Ratio

Debt to Assets Ratio indicates the proportion of the total assets that are financed by the liabilities of the company. Thus, it highlights the contribution of creditors in funding the assets of the company.

The total debt in the above formula does not include shareholder’s capital. The ratio above 0.5 indicates that the company’s major proportion of the asset is financed using the borrowings rather than from the investor’s fund.

Coverage Ratios

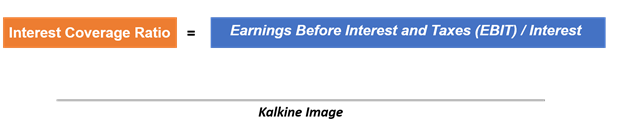

- Interest Coverage Ratio

The interest coverage ratio indicates how well a company can pay the interest on its outstanding debt using the company’s operating profit, (EBIT).

The high-interest coverage ratio indicates company is well positioned to meet its interest obligations via the business operations. Significantly, lenders, investors and creditors evaluate the interest coverage ratio for ensuring if they will be paid their dues in a timely manner.

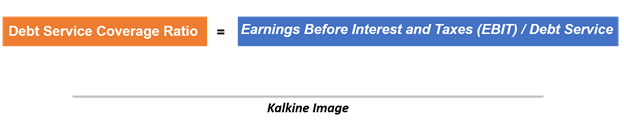

- Debt service coverage ratio

This ratio ascertains if the company will be able to pay its current debt obligations or debt service by means of its operating profit. Significantly, debt service includes the repayment of principal as well as interest on different debt types for a particular period.

Typically, DSCR of less than 1 signifies that the borrower will not be able to meet its current debt obligations from its business operations entirely.

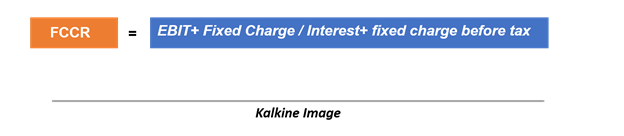

- Fixed-Charge Coverage Ratio

The fixed charge coverage ratio is the ability of the firm to cover fixed-charge obligations such as debt payment, and expense of leases and interest.

The ratio gives a broader measure of the company’s ability to meet the current due, including fixed charges on leases, principal repayment along with the interest return.

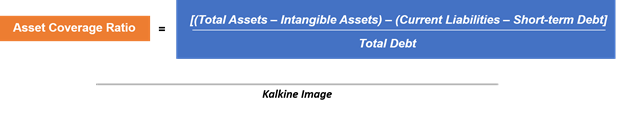

- Asset Coverage Ratio

The asset coverage ratio indicates how well the firm will be able to meet its borrowing obligations by selling the assets.

The higher value of the ratio indicates that the company has more assets than the liabilities. The banks and creditors use the ratio to analyse the risk associated with lending the capital.