Life insurance

Updated on 2023-08-29T11:56:18.481194Z

What is life insurance?

Life insurance is a financial protection plan to safeguard a family's financial future when the policyholder is no longer in a situation to support. During the unfortunate event, the nominee mentioned in the policy by the policyholder receives the economic benefit. It acts as a defence in protecting the family and loved ones.

The insurance policy also helps in managing finance in case

During accidental deaths, the dependents have to continue taking care of the liabilities such as rent, loan, fees for education. Amount from the insurance policy helps the beneficiaries with maintaining the lifestyle ahead.

In today's fast-moving life, life is uncertain, and ill-fated circumstances take a toll on both physical and financial health of the family. Life insurance, in a way, provides financial peace of mind to the family.

Life insurance gives assurance that after the incapability of the policyholder to provide financial support, the family members continue with the similar lifestyle without feeling the burden.

These policies usually provide lump sum money to the beneficiary. It allows the nominee to continue with their financial goals and acts as a valued asset.

Check the podcast on: Rising Health Claims. Are Insurance Firms Prepared?

How does life insurance work?

.png) Image: Kalkine

Image: Kalkine

In order to benefit the most from life insurance, experts advise availing the policy at the earliest stage of life. It is a contract where the policyholder pays a premium to the insurance company either as a lump sum or on a regular/monthly basis.

In the case of a circumstance such as the death of the policyholder within the term period, the insurance company pays to the family or the nominee of the policy the amount in the contract, i.e. life insurance policy.

Life insurance policy is given to the person earning a stable income through his skill or talent. If a person earning income through other mediums such as property rent or interest from fixed deposits, then the person will not be eligible to avail the policy.

Before giving the term policy, the insurance company does the complete health and medical check-up of the person. Many companies do not provide insurance if the person has existing severe health problems and diseases such as Cancer, but few have started covering critical illness in their package.

Life insurance policies typically provide higher income coverage compared to the income of the policyholder, and the range reduces as the age increases. Hence the insurance agents suggest taking the plan as early as possible.

Policyholders can choose the policy and its terms based on the need and the goal. Many companies provide various types of life insurance.

Good Read: Mental Health Claims Likely to Go Up; Are Insurance Firms Ready?

Image: Kalkine

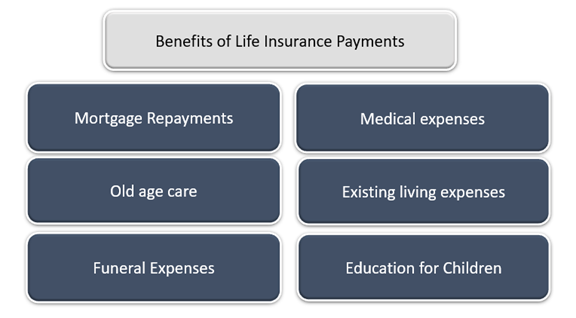

What are the benefits of life insurance?

Life insurance offers various advantages apart from the financial ones.

Protection: investing in the life term policies can provide a secure future to the family. In case of an unfortunate event, the beneficiaries would receive a sum assured plus any bonuses from the insurance company.

Life insurance not just helps the young kids who are dependent upon the policyholder, but it could also be used to assist the retired parents who may not have any source of income anymore. The beneficiaries can use the funds the way they wish.

As per the government of Australia, more than 70 per cent life insurance is purchased through Super funds. Super funds include much more than life insurance benefits to the policyholder such as Disability (total or permanent disability) and income protection. The policy then helps cover any current or future expenses of the person.

Tax Benefits: In many countries, life insurance provides tax benefits to policyholders. Especially for the salaried individual, it is the best way to reduce liability. The premiums paid towards term policies are tax-exempt.

Though in Australia, the premiums are only tax-deductible if they are connected to earning an assessable income.

Rehabilitation and living costs: This policy pays a lump sum amount to the policyholder to help with rehabilitation and living costs. Total and permanent disability (TPD) insurance provides various benefits if the person becomes seriously ill and disabled and is unlikely to work again.

Trauma coverage: Trauma insurance covers the person when diagnosed with a critical illness. A lump sum amount is given to the policyholder after getting diagnosed with a severe medical condition.

Income replacement: Income protection insurance is also called salary continuance cover. The policyholder enjoys a regular income for a specific period if they are unable to work due to temporary disability or illness.

Income protection insurance policy often uses a benefit amount which is the amount it pays per month. The amount can be set automatically, or the person can choose on its own.

Did You Read: Getting Quarantined: Insurance and Bank Dividends Under New Restrictions by APRA

How to decide on the life cover?

The person who wishes to avail the life cover needs to consider the financial needs of the family in future as every household as a different requirement. It also depends on circumstances like which stage of life are you in; type of insurance under consideration; financial obligations for a family and so on.

The government in Australia suggests everyone check if they have existing life insurance through super. Super funds provide life insurance as default service with premium cheaper than buying it directly as they buy insurance policies in bulk. In case an uptick is required in your insurance cover, it’s easily done through Super funds, only answers to a few medical questions and a medical checkup is needed.

Individuals can also avail life insurances from insurance brokers, financial advisors or directly from the insurance company.

Apart from the single insurance, life cover can be clubbed with its own or other insurance such as trauma, TPD and income protection insurance. But if the insurance is clubbed then at the time of claiming a certain amount, the cover from others may reduce.

Also Read: Lens on three ASX-listed insurance companies: QBE, IAG and SUN

How to pay life insurance premiums?

Premiums are usually recalculated during policy renewal. It increases each year as there is a higher chance of claiming the insurance policy as the age increases.

Conclusion

There are various companies offering Life insurance. The one buying should do its research such and decide on the right product from the right company. Research may include a few of the points mentioned below and invest wisely

- What all is covered in the policy

- What all information you will need to give to an insurer

- Details about the premium amount, method of payment

- Waiting period before a claim can be made

- Process to claim