Qualifying Ratios

Updated on 2023-08-29T11:55:40.390946Z

What is the qualifying ratio?

Qualifying ratios are also known as lending ratios which assess the capability of the loan applicant to meet certain obligations to repay the loan. These ratios are utilised during the loan underwriting process. Based on qualifying ratios, it is decided whether the loan can be passed or not. The acceptable range of ratio is dependent upon the market conditions and the lender’s policies.

Summary

- Qualifying ratios are also known as lending ratios that assess the capability of the loan applicant to meet certain obligations to repay the loan.

- Front–end–ratio and back-end ratio are the two types of qualifying ratio.

- A qualifying ratio is utilised to reduce the default risk.

- There are many types of qualifying ratios. The choice of ratio depends upon the policies of the lending agency.

Frequently Asked Questions

What is the importance of the qualifying ratio while underwriting a loan?

Banks utilise a qualifying ratio to reduce the default risk. Different banks have different standards for assessing the ratio, but all the banks follow the basic rule that debt-to-income should not be more than 0.36. Moreover, the expense-to-income should not be higher than 0.28. As per the banking regulations and stands, if the ratios are not met, then either the loan Is not issued, or the borrower has to pay a high interest rate or down payment.

What is the basic working of the qualifying ratio?

There are two major types of qualifying ratios, that is, front–end–ratio and the back-end ratio.

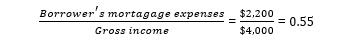

- In the front-end ratio, mortgage expenses to borrower’s gross income is calculated.

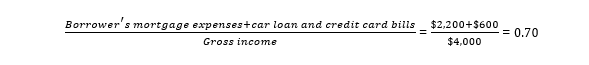

- In the back-end ratio, all the debt obligations (other liabilities) to the borrower’s gross income is calculated.

The working of the qualifying ratio has been discussed with the help of an example. Mr X presently earns $4,000 on a monthly basis. Furthermore, Mr X has to pay $600 for credit card bills and instalments for a car loan of $30,000. Mr X pursues a bank for a mortgage loan of $250,000 for 30 years with an interest of 8%. After the bank’s calculation, Mr X has to pay $2,200 every month, which includes mortgage, insurance, and taxes.

Bank employs a qualifying ratio, to determine whether the loan should be sanctioned or not, that is, the assessed capability of Mr X to repay the loan amount.

Front–end–ratio (mortgage payment to gross income)

Back-end-ratio (mortgage payment along with other payment obligations to gross income)

As per the banking standards, the loan will not be sanctioned to Mr X as the front-end ratio exceeds 0.28. Moreover, the back-end ratio is also exceeded by (0.70 – 0.36) 0.34.

What are the types of qualifying ratios?

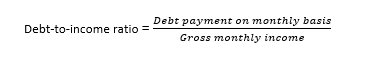

- Debt-to-income ratio: The ratio compares the debt payment obligations of an individual to their gross income. Gross income stands for monthly income before the other expenses like taxes.

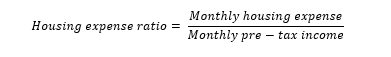

- Housing expense ratio: The ratio is employed in combination with the debt-to-income ratio. The ratio allows the comparison of the housing expenses with the income before tax. The maximum credit limit of the borrowers can be measured with the housing expense loan. Here, the housing expense includes the monthly instalments, house tax, interest, maintenance fee, and so on.

- Loan-to-value ratio: This ratio includes the value of an asset that will be issued to the borrowers. The portion of the asset which will be considered in the ratio is dependent upon the credit score of the borrower. For example, borrowers want a loan for a $1,000,000 house. After credit score assessment, only $70,000 is provided as a loan, and the rest $30,000 has to be paid by the borrowers themselves.

- Current ratio: It is also known as the working capital ratio, which compares the borrower’s current assets against the current liabilities for short-term loans. It highlights the capability of the borrower to repay the amount within a year and so.

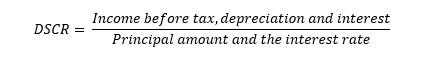

- Debt service coverage ratio (DSCR): The ratio is used when the loan must be sanctioned to an organisation. It assesses the ability of the organisation to repay the loan on the basis of its operating income. (SOURCE: https://corporatefinanceinstitute.com/resources/knowledge/finance/lending-ratios/)

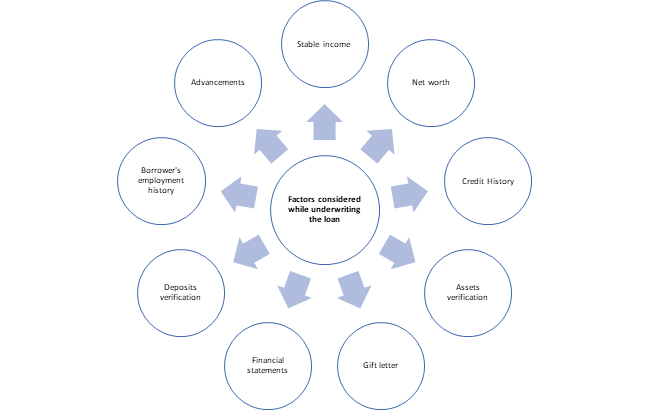

What factors are considered while underwriting the loan?

Source: Copyright © 2021 Kalkine Media Pty Ltd

A lender considers numerous factors while qualifying the borrowers for mortgage loans and is not limited to the above-discussed ratios.

- Stable income (monthly): Stable income stands for the gross income from secondary sources. It also comprises the durability, quality, bonuses, overtime incentives, maintenance, rental income, and verification of the source of income.

- Borrower’s employment history: This component assesses the stability in the income, job, and full-employment opportunity. The borrower with positive employment history is given more consideration. Furthermore, the basic criterion is that borrowers should be associated with a firm for more than two years.

- Advancements: In case the borrower has upgraded their employment for advancement in the income, then it is considered favourable. On the other hand, if the borrower shows a history of hopping from one job to another then, they might face some problems.

- Net worth: The creditworthiness of the borrower can be assessed from the net worthiness. Net worthiness stands for the annual savings, investment patterns, and earnings, along with the skills to manage finances and wealth.

- Credit history: Before sanctioning the loan, the credit report deposited by the borrower or the bureaus of credit rating is assessed in detail. FICO (Fair Isaac Corporation) score projects the credit worthiness of the borrowers. The credit score can be increased or maintained by fulfilling the monthly debt obligations on time, the debts should be limited, restrict the credits, pay the credit on time, and project a positive credit history.

- Assets’ verification: Under the section of asset verification, the banks undertake various steps to assess the assets listed by the borrowers.

- Deposits verification: The lender institution sends the deposit verification form to the borrower’s bank to achieve approval about the deposits. The borrowers are not involved in the process. The deposit verification can be undertaken by an alternative method, that is, three months bank statement is deposited by the borrowers.

- Financial statements: The statements of the companies provide information regarding the diversity and sustainability of the company’s resources. It summarises the liabilities and asset structure along with discloses the net worthiness.

- Gift letter: In case, the borrower lacks funds for closing the deal, then a gift letter can be signed by the relatives of the borrowers, which indicates that a specific amount has been donated by the concerned authority.