Value at Risk (VaR)

Updated on 2023-08-29T11:56:35.823207Z

What is Value at Risk (VaR)?

Value at Risk is a statistical quantity showing the riskiness of a financial asset or a portfolio of assets held by an investor or an entity. It is a measurement used to assess the financial risk to a company, investment portfolio or open market position over a period of time. VAR is a probability-based measure of the potential loss. VaR also estimates the probability of occurrence of this loss.

The concept was developed by J.P. Morgan as an idea to simplify the measurement and management processes of risk. The basic question answered was, "How much can one lose at a given certainty in a given time?". So it describes the possible loss at a certain confidence level within a certain time horizon. Key Elements of Value at Risk are Specified amount of loss in value or percentage, Time period over which the risk is assessed and Confidence interval.

Summary

- VaR is a probability-based measure of the potential loss.

- It focuses on rare events and is easy to interpret.

- VaR is normally presented as a percentage within a given timeframe.

- The value at Risk concept can be used for all types of assets – bonds, shares, derivatives, currencies, etc.

Frequently Asked Questions (FAQs)

How is Value at Risk (VaR) Important for an Investor?

VaR has gained substantial importance as a risk metric. A major reason for its popularity is its’ intuitiveness and ease of interpretation than other risk measures such as variance. Higher volatility in exchange markets, credit defaults, situations of uncertainty are called risks and managing them is one of the main tasks of an Investor. This risk measure focuses on rare events.

By using this concept, it has become possible to aggregate the risks and to provide one number for the management of risk. This metric is most ordinarily employed by investment and financing organizations to work out the extent and occurrence ratio of potential losses in their institutional portfolios. Investment banks apply VaR modelling to ascertain firm-wide risks, as they are exposed to highly correlated & risky assets.

How can it be calculated?

VAR can be calculated using different techniques classified as parametric and non-parametric. The users of the concept will have to set a time horizon for which they want to calculate the Value at Risk, as well as preferred confidence level. VaR is normally presented as a percentage within a given timeframe. The most frequently used methods are elucidated below-

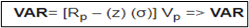

- Parametric Method- Also known as the variance-covariance method, it assumes a normal distribution in returns. Two factors are to be estimated – an expected return and a standard deviation. This method aptly works where the distributions are known and consistently estimated. The method cannot be used for a very small sample size. For example, if the portfolio value is USD 20,000 and if 1-month average return and the standard deviation is 10% and 15%, respectively. Daily VAR at a 5% level of significance is calculated as

Where,

Rp = Return of the portfolio,

Z= Z value for 5% level of confidence in one-tailed test,

σ = Standard Deviation of the portfolio,

Vp= Value of the portfolio So,

[0.1 – (1.65) (0.15)] 20000 => - USD 3000 (rounded) => 15% of the Portfolio.

Thus, there is a 5% chance that a minimum loss of 15% of the portfolio (i.e. USD 3000) will occur within the next one month. In other words, we are 95% confident that the loss will not exceed USD 3000 in the next month.

- Monte Carlo Method- here, VaR is found by randomly creating a number of scenarios for future rates using non-linear pricing models to estimate the change in value for each situation and then computing the VaR according to the worst losses. This method is appropriate for a countless range of risk measurement difficulties, especially when dealing with complicated factors. It assumes an acknowledged probability distribution for the risk factors. For example, for a portfolio of 100 stocks, we have to input the standard deviation of all the stocks along with the correlations among all of them to calculate the standard deviation of the portfolio. Nearly 5,000 correlations are required for this. So, we can say that this method is as good as its inputs.

- Historical Method- it is the simplest method for calculating Value at Risk. For example: if the market movements for the last 300 days is taken to calculate the percentage change for each risk factor on each day. Each percentage change is calculated with current market values to present 300 scenarios for future value. Another simpler way can be to compute the 5% monthly VAR, and we look at the 5th percentile of the monthly return distribution graph.

How is it Beneficial?

- It is easy to understand and use in analysis and so is often used by investors or firms to look at their potential losses.

- It is also used by traders to control their market exposure. It studies the scenarios of loss and can act as a guiding risk management strategy.

- Value at Risk is a single number metric indicating the extent of risk in a given portfolio. It makes interpretation and understanding simple.

- The value at Risk concept can be used for all types of assets – bonds, shares, derivatives, currencies, etc.

- It is very useful in minimizing risks and maximizing returns. One doesn’t have to be a statistical expert and know complex calculations to compute VaR.

What are its limitations?

- While quantifying probable loss within a given level, the size of the loss associated with the tail of the probability distribution out of the confidence level cannot be determined.

- VaR is not an additive metric, meaning the VAR figure of a single asset of a portfolio cannot be added to the VAR of the overall portfolio. This is because VaR does not take correlations into account.

- The different methods may give different results as there is no standardized method of data collection.

- VaR computation doesn’t consider the liquidity risk directly. It just focuses on the market risk.

- VaR metric works on assumptions and uses them as inputs, making it prone to errors.

- It doesn’t disclose the maximum possible loss. The actual risk to a portfolio can thus be higher than the VaR figure.