Working Capital

Updated on 2023-08-29T11:59:04.385542Z

Working Capital

Running a business is not everyone’s cup of tea. This may be the only thing which no business owner can deny. Cruise control feature doesn’t exist in any business, i.e. regular evolvement of business is important and is neither dependent on the number of years of business existence, nor on the industry, the business belongs to such as Technology, Medical, Construction, Service Sectors etc.

What is working capital/net working capital?

In simple terms, capital refers to money. Working capital is the money that is available to fund the daily operations of a business.

Working capital is an indicator of near-term financial position of a business and a measure of its operational efficiency. It shows the ability of the business to meet its short-term obligations/current liabilities through its current assets.

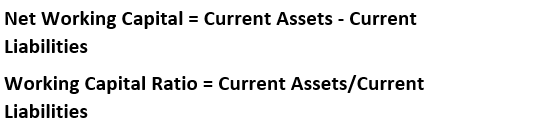

Dividing current assets by current liabilities gives the working capital ratio. If a company has $2 million of current assets and $1 million of current liabilities, the working capital ratio would be 2:1 ($2 million/$1 million), meaning that the business has $2 in hand for every $1 of obligation.

Likewise, net working capital would give the amount of the funds that a business has in hand to meet current liabilities. In the above example, net working capital would be $1 million ($2 million - $1 million), indicating that business has $1 million of headroom to meet its near-term obligations.

Is negative working capital good for business?

A negative net working capital would mean that a business may need additional financing to meet its working capital. In simple words, current liabilities in the balance sheet are in excess of current assets. It is an indication of business having higher liabilities. But negative working capital is favourable for select business models at certain times.

Consider businesses like Dominos, McDonald’s, Woolworths, Kogan.com, Amazon.com that realise revenue instantly at the point of sale before paying their suppliers. Such business models are high cash generative and fund sales through suppliers.

An enterprise with a high reputation with its suppliers may have negative working capital due to their ability to bargain with the suppliers. When the supplier of the business finances parts of current assets, it will save the need for working capital financing and associated interest costs.

But negative working capital could be favourable at certain times for some business models. It is because a long term negative working capital can raise questions on the liquidity management of the business.

For instance, if a company has large debt maturity over the next year, it will also add to negative working capital. Or, when an enterprise is building inventory in anticipation of a bumper demand over the near future, it would buy more from suppliers and may take short-term debt to support anticipated demand, thereby increasing current liabilities.

Moreover, it is imperative to scan financial statements for a period of a few years and find more answers since looking at just working capital of the business may not give a long-term picture

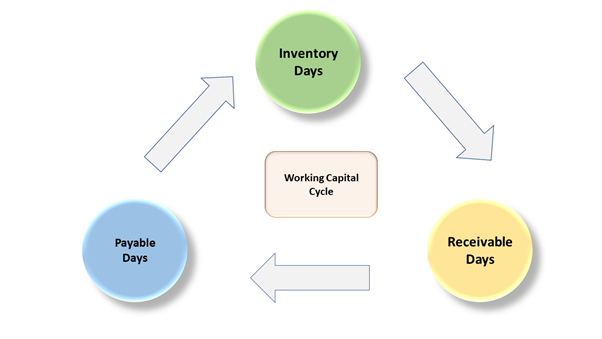

What is the working capital cycle?

Working capital cycle is the time taken by a business to convert net current assets less liabilities into cash. A shorter working capital cycle means that a business realises cash in a short period of time. It also indicates the operational efficiency of the business.

“Turnover is vanity, profit is sanity, and cash is reality”

Companies with shorter working capital cycle are relatively more efficient than the companies with longer working capital cycle or a greater number of working capital cycle days. In cases where companies have a longer working capital cycle, it would mean that the business payout period to suppliers is shorter than the period for receiving cash from customers.

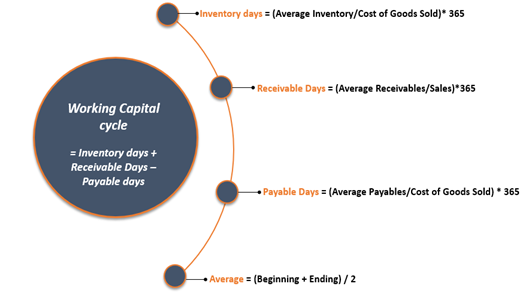

Receivable days indicates the number of days an enterprise takes to receive cash from its customers from the credit sales made earlier. Inventory days means the number of days it would take to clear inventory through sales. Payable days are the number of days an enterprise takes to pay its suppliers.

Consider the below information:

- Inventory Days: 60

- Receivable Days: 50

- Payable Days: 100

Working capital cycle would be 10 days (60+50-100).

The business takes 50 days to realise the cash made on sales, but it takes 100 days to pay its suppliers. It is understandable that the business takes, on average, 60 days between acquiring the product and delivering to the customer. It is also apparent that the company 100 days of the payable cycle is funded by suppliers, leaving the company with 10 days of a funding shortfall.

What causes changes to working capital?

Although changes to working capital can be strategic at times, some basic ones include the following.

Credit sale agreements: Any changes to the sales agreement would impact the working capital of the business. Usually, B2B businesses are run on credit, if a company reduces the number of days for payment due by debtors, it will improve the working capital cycle and increase cash, but customers could be discouraged to buy more. But when a company increases the credit days for its customers, it will further stretch cash conversion, and the customer could be inclined to buy more.

Expansion and inventory build-up: Business expansion requires capital to invests in areas such as machinery, premises, marketing, hiring etc. When a business is expecting sales to be higher as a result of expansion, it may need to be build-up inventory to support the sales.

How companies finance working capital needs?

Short-term business loan: It is a popular credit facility, especially provided for working capital purposes, where the tenure could be as short as three months. Such financing meets the funding needs of the business during emergencies.

Factoring: In this type of financing, the companies offer their account receivables to factoring service providers at a discount, realising cash instantly on an invoice which could be due after a few months.

Line of credit: Business line of credit is similar to business credit cards, which can be used for working capital financing. Businesses/Borrowers can draw funds up to the maximum limit of credit provided to them, which depends on the creditability of the business and the track record of success, and pay interest thereafter. Once the repayment is made, the full limit is available again.

Debt or equity: Many companies also use traditional sources of funding, especially large companies. While raising funds through capital markets, companies often make provision for working capital purposes out of the total raised money. Banking facilities are also a popular source of working capital financing.