Coin Burning

Updated on 2023-08-29T12:01:49.711590Z

What is coin burning?

Coin burn is a term used in the crypto world for tokens or coins sent to an ‘eater address’ for elimination. The cryptocurrency coins or tokens sent to the eater address become useless in the crypto markets. However, the transactions related to them do not just wash out. Any person can access the transactions anytime as they remain publically recorded and available on the blockchain. These coins get sent to a public address from which the private keys of these tokens get eliminated, becoming unobtainable or unspendable.

Summary

- Coin Burning is a crypto market-specific way of making tokens and coins unspendable.

- The coins burnt are not available for trade on the crypto network, but all transactions related to them remains on the blockchain.

- Coin burning is a common, transparent, and fully verifiable process that regulates the coin supply and demand.

Frequently Asked Questions (FAQ)

How to burn coins or tokens?

Coin burning is a method of removing existing crypto coins or tokens from a crypto wallet. Thus, a specific portion of coins gets removed from circulation. The purpose often is to control the price of a cryptocurrency or crypto token.

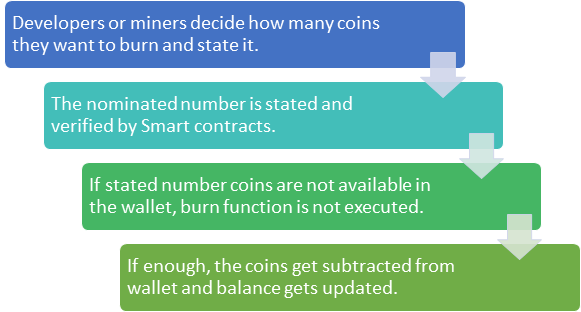

Crypto burning is a very visible process. Anyone can verify the burning of the crypto token on a currency blockchain. However, a miner or crypto developer must first fix the number of coins they seek to remove from circulation. The decided number is then verified with the help of smart contracts. Finally, the available balance of tokens is verified in the miner’s wallet.

If the decided crypto burn quantity is available, it gets burnt or removed from circulation in the crypto market.

Source: Copyright © 2021 Kalkine Media

The coin burning process eliminates the designated number of coins being used in the cryptocurrency market. The chosen quantity of coins is sent to a so-called ‘eater address’. It removes the private key of the crypto tokens being burnt.

Without any private key, the coins deny access and cannot be used for any purpose. The ultimate result is the effective removal of the coins.

What is proof of burn for cryptocurrency?

One mechanism with which the users burning their tokens gain mining rights is the proof of burn (PoB) consensus.

PoB method uses a decay rate reducing total mining capacity with an existing miner whenever it verifies a transaction. As a result, it ensures that miners constantly invest more tokens for burning, thus maintaining coin trading competitiveness.

Like proof of stake (PoS), it makes crypto miners lock up their existing assets to gain mining privilege. It is just another consensus algorithm in use.

The method is energy efficient and balance in nature. Miners are allowed to burn virtual currency tokens in return for the right to write proportionate blocks.

Burnt coins start acting as mining rigs. As miners burn coins held by them, they get access to virtual mining rigs gaining power for crypto block mining. If miners burn more coins, bigger is the virtual mining rig he can access.

The POB mechanism promotes a periodic burning of cryptocurrency coins to avoid any unfair advantage for early adopters. It, in this way, maintains mining power on the chain. It also promotes regular mining activity rather than making it a one-time thing.

Source: © Rastudio | Megapixl.com

How does coin burn affect the price?

The two major purposes behind coin burning are –

- To slow down inflation rates, i.e., the general price rise or

- Reduce the number of coins in circulation.

When the supply of coins is reduced in circulating supply, there strikes in a scarcity of coins, making them more valuable and rewarding for remaining long-term cryptocurrency holders.

If compared to regular securities, market coin burning is like a stock buy-back. In essence, the buy-back process reduced the total amount of outstanding units of capital. As a result, it helps strengthen or recover the value of the remaining shares available for trade-in markets.

The process is directly rewarding to the blockchain project developers who are long-term stakeholders in the cryptocurrency world.

Reducing the availability of coins for trading affects prices makes existing invested holders richer. Thus, the fundamental demand-supply matrix sets into function, driving crypto value northwards.

For example, if 25000 Ethereum coins are available for trade on a date and one crypto miner decides to burn 5000 coins. Then, after verification and coin burning, the circulating supply of Ethereum coins will be 20,000.

The entire coin burning is very transparent and easy to verify for anyone. One consensus mechanism associated with coin burning is the proof of burn. Using this, a consensus is developed to allow miners to burn their holding.

Source: © Eamesbot | Megapixl.com

What are the benefits of crypto coin burning?

The coin burning process has the following benefits.

- It is a common method used to correct errors or for removing tokens from circulation.

- It is a control mechanism to regulate the demand and supply of crypto coins.

- Coin burning makes it more valuable for holders and acts as an incentive for coin holding.

- In addition, fewer coins available for sale or exchanges are more valuable is the individual token.

- Token burnt are also sometimes carried as a security layer on the blockchain to avoid spamming of transactions.

- Token burning in a way reduces the number of miners and reduces the need for resources and competition.

- In a security token, the holders to whom dividends are to be paid gets reduced.