Market Portfolio

Updated on 2023-08-29T11:54:48.441196Z

What is Market Portfolio?

The market portfolio is a basket of assets created by an investor using diversified set of investments. The basket can include securities like pension plans, mutual funds, stocks, real estate, bonds, foreign currencies, and assets like silver, gold, coins, bitcoins to name a few. Chiefly, the assets in the portfolio either provide a return or an increase in value.

A market portfolio is said to be optimum when a variety of assets and securities are included in it ranging from small-cap stocks to bonds to physical assets. For example, few might invest in assets that decrease in value when the overall market is increasing to maintain the return in case a market downturn occurs. Maintaining the flow of higher or stable returns is crucial to managing the portfolio.

Summary

- Market portfolio refers to a basket of assets used by investors to reduce the risks attached to their investments.

- The basket includes securities like pension plans, mutual fuds, stocks, real estate, etc.

- A market portfolio is said to be optimum when the securities included in it are varying in nature, ranging from small-cap stocks to bonds and physical markets.

How is the market portfolio managed?

A market portfolio is created with the aim to choose the right combination of the asset classes to maximize the returns and simultaneously minimize the unsystematic risk (diversifiable risk). Portfolio creation and management are not the same, as creation is a one-time action and management must be done on a regular basis as per the changing market circumstances.

Under portfolio management, the portfolio is continuously monitored and amendments are made to achieve maximum return with minimum risks.

It is crucial to create a portfolio strategically as different asset classes behave differently and few indexes might behave in a similar fashion. For example, real estate projects completely different results in comparison to stocks and bonds. By analyzing the indexes, the investor can gain the return they desire.

Actively managing the portfolio has the following implications-

- Income can be generated for a longer duration and risks can be cushioned.

- Investment strategies can be developed to rebalance the securities as per the investment aim.

- Portfolios can be customized on a real-time basis in consideration with the volatile market conditions.

- Management further allows investigating the assets which can add to the returns.

For creating and managing the portfolio, it is necessary that investment goals are pre-decided. For managing the portfolio, either the investor should have knowledge about the market or should take professional help.

How to create an optimum portfolio?

Source: Copyright © 2021 Kalkine Media

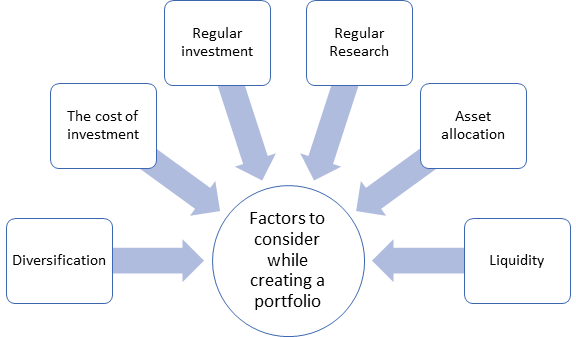

The portfolio composition is dependent upon numerous factors-

- Diversification – A strong portfolio should be diversified to avoid the impact of a sudden market downturn. Diversification allows the reduction of risk by investing funds across different securities which have a different risk-return profile. These securities have a different reaction to a similar event, in effect, the stability in the income is maintained. Therefore, investors can protect themselves from the changing market conditions.

- The cost of investment – The investment cost is significant in terms of management and commission fee. The cost increases considerably when the stocks are purchased or sold on a daily basis. This cost can be minimized by investing with brokerage firms that offer services at a lower cost.

Moreover, when investment is made for long-term profits, then the sale and purchase decisions should not be made based on the daily price change as it adds to the cost.

- Invest regularly – Investment discipline can give extra returns to the investors. With the increase in regular income, the portfolio can be strengthened to gain benefit from the market change.

- Careful asset allocation – This is relevant when the investment is made in new securities as their performance is not predictable and it adds risk to the portfolio. To keep the money safe, it is suggested that investors should not rely completely on the new stocks at the initial level. However, over a period, investment can be increased if the stock outperforms in the market or meet the expectations.

- Regular Research – To gain the advantage of the investment, research should be undertaken as it is the backbone of the market. The research will give an insight into the current market and would help in making decisions. Either top-down or bottom-up research techniques can be adopted. Additionally, it is crucial that both qualitative and quantitative data are used while making an investment decision.

- Holding Cash – It is essential that investors have liquidity as it acts as a safety when the market shows a sudden change in the market. Cash allows changing the portfolio as per the investor’s decision.

What are the types of market portfolio?

- Defensive – The beta of securities of a defensive portfolio is comparatively low. The aim of this type of portfolio is to save the principal. Those stocks are included by the portfolio which does not relate to the market movements. The investors aim at minimizing risk and take only minimum returns.

- Aggressive – It is the most utilized portfolio which takes high risk for higher returns. With the presence of high beta, the advantage of stock fluctuation is taken to earn profits. Investors have to monitor the portfolio in order to manage a high amount of risk. The portfolio’s success is dependent upon minimum losses.

- Income – This portfolio is dependent upon the dividend as profits from investment. The cash flow is generated through interest or dividend distributed by the companies to their shareholders. The securities of the income portfolio are largely affected by the economic downturn or upturn.

- Speculative – It is considered as the riskiest investment as the investment decisions are made either during Initial Public Offerings or are based on rumors. It is expected that breakthroughs will be created in the market because of technology or new business strategy.

- Growth – Those securities are included in the growth portfolio which are projecting significant growth or are expected to grow in the future because of present decisions. The risk component is high and simultaneously the rewards are also high.

- Value – Low valued securities are included in the portfolio as the securities can be bought at a lower price after a bargain. In the time of economic downturn, the price of these securities barely survives and a majority of the investors shift towards profitable stocks. After the economic revival, these securities generally provide considerable income to investors.

While creating a portfolio, there are innumerable factors that affect the investment decisions which are not limited to the macro and micro factors like beta, economic conditions, company’s performance, past trends to name a few. Behavioral factors also play a crucial role in constructing a portfolio.