Absorption Costing

Updated on 2023-08-29T11:54:07.021103Z

What is Absorption Costing?

Absorption costing is a method of management accounting used in valuing inventory. It is the procedure of allocating/apportioning all overhead costs over a particular cost center generally a production department by the units produced in that department. Elements included in this costing classification are the cost of supplies and labour, along with both flexible and static industrial overhead costs. Few of the costs related with manufacturing a merchandise comprises of wages for workforces bodily working on the merchandise; the raw ingredients used in creating the merchandise; and all overhead charges like convenience costs (electricity, rent payment and others). Absorption Costing is also termed as Historical Costing as there will be roughly a time break amid incidence of costs and recording of charge for information to the controlling supervisors.

What are the Constituents of Absorption Costing?

The extensive heads of costs allocated to products/ services underneath an absorption costing classification are:

- Direct materials - materials that are directly identifiable with a finished product/ end service. Example- API (Active Pharmaceutical Ingredients), used in Pharmaceutical Industry.

- Direct labor - labor costs attributable to the production crew. Example- wages paid to employees in an assembly line.

- Variable manufacturing overhead - costs essential to operate a production facility, which fluctuate through production size. Example – packaging materials and power for production apparatus.

- Fixed manufacturing overhead - expenses needed for functioning of an industrial facility, which do not fluctuate with manufacturing capacity. Example- are rent of premises and warehouse insurance.

In what steps is Absorption Costing Calculated?

In Absorption costing anything that is a direct cost is included as product cost. In contrast to the other substitute valuation method such as variable costing, each cost is apportioned to merchandises produced and not as it is vended. Steps essential to Absorption Costing:

- Identifying cost pools i.e. a standard set of accounts are classified as cost pools and are rarely be changed.

- Calculating usage which means determining the usage of an activity measure, used to assign overhead costs, like machine hours or labor hours.

- Assigning costs by dividing the total costs by usage measure and allocating them to cost pools.

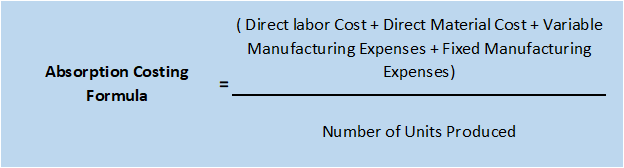

Formula

Copyright © 2021 Kalkine Media Pty Ltd

Examples

- A company manufactures 10,000 items of merchandise in a month. Out of these 10,000 units produced, only 8,000 are traded in that month and 2,000 units remain in the stock .

- Each unit requires AUD 5 of raw materials/ ingredients and labour staff work. Moreover, the manufacturing facility needs AUD 20,000 of monthly fixed overhead expenses.

- Using the Absorption Costing technique, the company calculated that there are AUD 2 of fixed overhead costs, going into the industrial activity where, each unit’s cost is found by distributing the fixed overhead costs over the quantity of units made during that month (AUD 20,000 / 10,000 units = AUD 2 per unit).

- Subsequently, the company can add the cost attributable to labour staff and raw material to conclude that each unit manufactured has an absorption rate of AUD 7 (AUD 2 fixed overhead charges + AUD 5 variable overhead charges = AUD 7).

- The business can then compute that the overall cost of goods traded is AUD 56,000 derived by multiplying the absorption charge with the quantity of units traded (8,000 units vended for AUD 7 cost-per-unit = AUD 56,000). This means that AUD 14,000 value of residual stock (2,000 units unsold AUD 7 cost-per-unit = AUD 14,000) is still with it.

What are the objectives of Absorption Costing?

- Helpful in recognising departmental contribution in product cost.

- Quickly determines the overall cost of any product.

- Helps to analyse whether or not resources are properly utilised.

- To discover and fix the transaction price to be cited in the marketplace based on cost plus profit basis.

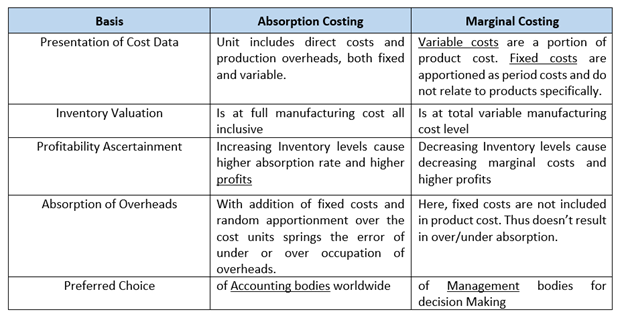

What are the differences between Absorption Costing V/s Marginal Costing?

Marginal Costing can be differentiated with Absorption Costing on the following basis-

Copyright © 2021 Kalkine Media Pty Ltd

Copyright © 2021 Kalkine Media Pty Ltd

What are the advantages & disadvantages of Absorption Costing?

The major advantages of absorption costing are:

- Distinction of costs into fixed and variable constituents is not really required as everything in included in product cost.

- Examination of over/under absorption of overheads can reveal any inefficiencies in the production.

- Absorption costing is based on the accrual theory by identifying revenue with costs for a certain time.

- Estimation of inventory is compliant to accounting ideals where fixed manufacturing costs are captivated into inventory cost.

- The allocation & distribution of fixed manufacturing overheads helps in cost management of costs and services rendered.

- Even if sales are more/less than the planned levels, absorption costing guarantees all costs are enclosed.

Major disadvantages of absorption costing are:

- Not of much use for Decision-making as presentation of cost data is such that a reasonable cost-volume-profit relationship cannot be established.

- Unsound Practice in the sense that all fixed charge is not apportioned alongside the revenue of the period in which they are incurred.

- Behavioural arrangement of charges is not underlined. Numerous situations are likely to go unnoticed in absorption costing.

- Absorption costing hangs on on volume of production which varies from year to year, so overhead rates centered on usual volume cannot be determined.

- Where fixed costs are undividable, the distribution of these over cost units results in erroneous product costs.

- Captivation of fixed costs to stock effects not only in over-valuation of goods in stock but also in over-statement of income.