Black Monday

Updated on 2023-08-29T11:57:15.814794Z

What was Black Monday?

On 19 October 1987, the Dow Jones Industrial Average (DJIA) lost over 22% in a single day, dubbed as "Black Monday." It became one of the most well-known financial days in history, as it marked the start of a global stock market downturn. As a result, by the end of the month, most of the leading exchanges had lost more than 20% of their value.

Economists blamed the disaster on geopolitical developments and the introduction of computerised programme trading, which hastened the sell-off.

Summary

- The stock market disaster that happened on 19 October 1987, when the DJIA lost about 22% in a single day, causing a global stock market collapse, is known as Black Monday.

- To avoid panic selling, market safety devices such as circuit breakers and trade curbs have been implemented since the Black Monday disaster.

- Investors can take preventative measures to deal with the risk of another stock market fall like Black Monday.

Frequently Asked Questions (FAQs)

How did Black Monday occur?

Before Black Monday, there were some alarming warning signs for investors. The Dow Jones Industrial Average dropped over 4% on 14 October and then plummeted another 2.5 %. The day after that, 16 October, the Friday before Black Monday, saw a devastating 5% drop in London stock markets, which coincided with the Great Storm of 1987, unexpected natural disasters that formed hurricane-force winds in the English Channel and contributed to two fatalities.

Source: © Doomu | Megapixl.com

On Monday morning, the crash occurred in Hong Kong. As other markets felt the aftershocks of the first drop, the impact persisted throughout Asia and the Asian trading session. When the London market session commenced, the market chaos continued to spread across Europe. By the time the U.S. financial markets opened, stocks were practically in freefall. The DJIA had lost more than 500 points, and the S&P 500 had lost more than 55 points by the end of the day.

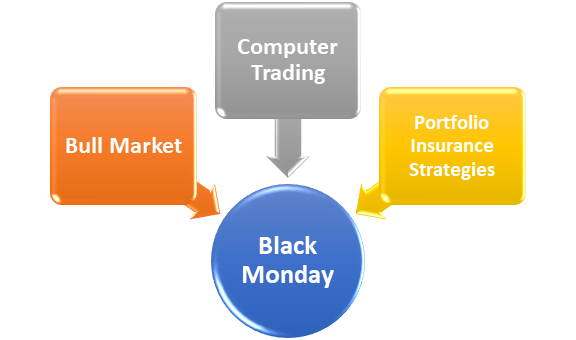

What was the root cause of the Black Monday crash?

A bull market

Many market analysts believed that the 1987 Black Monday meltdown resulted from a long-running bull market ripe for a significant correction. Since its commencement in 1982, a primary bull market has not seen a single substantial corrective pullback of prices, and 1987 was the fifth year of that bull market. Stock values had more than tripled in price in the four and a half years leading up to the Black Monday disaster, with 1987 alone experiencing a 44 % surge.

Computer trading

The other cause of the significant fall was a computer, or programme trading, which was new to the markets in the mid-1980s. Brokers were able to execute trades more quickly and place larger orders because of the usage of computers. Furthermore, software programmes developed by brokerages, banks, and other organisations were programmed to automatically execute stop-loss orders, effectively selling out positions if stocks fell by a particular percentage.

On Black Monday, computerised trading systems created a domino effect, speeding up the selling as the market fell, causing the market to lose even more.

Portfolio insurance strategies

The third element that led to the catastrophe was portfolio insurance, which, like computerised trading, was a novel phenomena at the time. Large institutional investors used portfolio insurance to hedge their stock portfolios by taking short positions in S&P 500 futures. If stock prices fell significantly, the portfolio insurance techniques were designed to raise their short futures holdings.

The method has the same domino effect as Black Monday's computerised trading programmes. As stock prices fell, large investors sold more S&P 500 futures contracts short. In the futures market, the downward pressure added to the stock market's selling push. In brief, the stock market fell, which led to an increase in short selling in the futures market, which led to more investors selling stocks, which led to more investors shorting stock futures.

Before Black Monday in October, concerns about interest rates, oil prices, trade imbalances, and inflation prompted warning signs of heightened volatility and a few severe down days in the market.

However, markets did not continue to rise permanently, and portfolio insurance schemes and computer trading occurred unexpectedly, resulting in the 1987 crash. As a result, the market needed a price correction urgently since stocks had grown overvalued.

Source: Copyright © 2021 Kalkine Media

What is the fallout from Black Monday?

The Black Monday crash resulted in the invention and implementation of circuit breakers. Following the 1987 crisis, stock exchanges worldwide introduced circuit breakers, which temporarily halt trade when major stock indices fall by a certain amount.

Source: © Wrangler | Megapixl.com

The goal of the circuit breaker system is to try to avoid a market panic in which investors liquidate all of their holdings at once. It's widely assumed that widespread panic was responsible for most of the Black Monday crash's severity. Temporary halts in the trading process are set up under the circuit breaker system to give investors a chance to catch their breath and, ideally, make logical trading decisions, avoiding a panicked stock sell-off.

Is it possible for Black Monday to reoccur?

Since the Black Monday catastrophe, protection mechanisms such as circuit breakers and trade curbs have been incorporated into the market to avoid panic selling. However, supercomputer-driven high-frequency trading (HFT) algorithms move large volumes in milliseconds, increasing volatility.

HFT gone wrong caused the 2010 Flash Crash, which sent the stock market down 10% in a couple of minutes. This resulted in tighter price bands, yet the stock market has been volatile since 2010. With the rise of technology and online trading, the market has become riskier.

Markets lost similar amounts in March when jobless rates hit their greatest levels since the Great Depression, before recovering through the summer of that year amidst the 2020 global COVID19 epidemic.