Cash Budget

Updated on 2023-08-29T11:58:12.417603Z

How can we define a cash budget?

A cash budget can be defined as the estimated evaluation of the total cash flow within an organisation. Cash budgets can be prepared on a weekly, monthly, quarterly or yearly basis. This budget basically enables a company to develop an awareness about its overall monetary strength. It also helps a company to monitor the productivity of the cash that is being invested for operations.

A cash budget incorporates a summary of the estimated revenue, operation investments, sales, financial investments and liabilities. It portrays an overall clear picture of the entire cash flow scenario taking place in a business.

Summary

- A cash budget is a projected assessment of an organisation's entire cash flow operations over a given time period.

- The cash budget could be prepared by following three simple steps- Cash inflow forecast, cash outflow forecast, cash balance forecast.

- It portrays an overall clear picture of the entire cash flow scenario taking place in a business.

How to prepare a cash budget?

A cash budget portrays a complete picture of the financial transaction scenario weekly, monthly, quarterly, or annual. The following are the steps followed while preparing a cash budget:

The cash inflow forecast analyses all the expected sources from where cash inflow during a particular time frame. This cash inflow is predicted and then added up with the initial account balance that the company initially owned at the beginning of the budget period. Some of the examples of these sources are cash generated through sales received in exchange for a service or product, cash received through some company asset, and cash received in exchange for selling bonds and stocks.

The cash outflow forecast analyses all the expected expenses that a company might suffer during the same time frame. The cash outflow is subtracted from the total account balance that the company owns after the addition of the cash inflow during the entire budget period. Some of the examples of cash outflow are operation expenses, purchase of any fixed assets, employee payment, financial investments, liabilities, dividend distribution, etc.

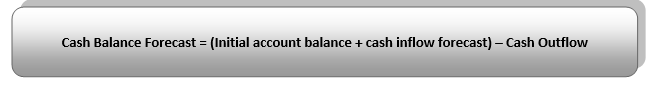

The cash balance forecast is the estimation of the net account balance that remains with the company at the end of the evaluation of the cash inflow and cash outflow. In order to do so, the cash inflow is first added with the initial account balance, and then the cash outflow is subtracted from it.

This is the final figure that determines the company's financial strength. On seeing the strength, the company may further take decisions regarding other investments for business purpose.

Image source: © Rawpixelimages | Megapixl.com

Why is it essential to have a cash budget?

Every business organisation predicts their production and sale. They also predict their revenue collection in this process. A cash budget is a predictive summary of the cash flow activities that might take place in the company during production and sale over a particular period of time. Therefore, a cash budget gives an overall idea of the monetary strength of the company, if they will be able to continue their production and sustain it. The cash balance forecast is calculated by:

Image source: Copyright © 2021 Kalkine Media

The net account balance of the company as obtained by cash budgeting is considered to be the initial account balance for the next cash budget.

What is the significance of a cash budget?

- Essential for proper planning

The analysis of cash budget provides an overall idea of the financial scenario of a company which enables them to develop their business strategies as per their financial status. A company will be aware of their estimated cash inflow and outflow well in advance so that they realise if they can sustain their production in the future or not. If yes, then great, else they can prepare themselves for a debt from advance and develop strategies for repaying their debt as well.

A company must have enough liquid cash to sustain its operations, else they need to consider other options for strengthening its capital.

Image source: © Bsenic | Megapixl.com

- Significant for handling seasonal variations

Usually, there is always a positive cash budget in every business. However, at times, sales do get affected due to seasonal variation. For example, a company that manufactures air conditioners would not experience demand for the product in the winter as much as it would during the summer.

A cash budget analyses the estimated sale of a company and predicts the sale figure that depends on the season. Having well aware of the sales may help the company to produce only the amount that is in demand. No extra money would be wasted due to the surplus in production.

As a cash budget analyses the estimated cash resources of a company, it prepares the company management to prepare for all situations. If there is a deficit of money in the fund, the company can prepare for debts and liabilities. Generally, the cash budget is always a positive one. Thus, a company can plan their production, give out salary to the employees, invest in the raw materials for production, etc. It can rightly be concluded that a cash budget helps the company to grow and add value to the brand.

What is the difference between a short-term cash budget and a long-term cash budget?

Short-term cash budgets refer to the budget statements that are analysed on weekly basis. It mainly focuses on the cash requirements or cash income that could be expected within a week. These mainly include bills payment, rent, payroll, etc. They do not require to be much strategic and are less time-consuming.

Long-term cash budgets are the ones that hold a time period of a month or a year. It requires more strategic planning and is time-consuming as compared to the short-term cash budgets.