Earnings

Updated on 2023-08-29T12:01:56.085574Z

What is a company's earnings?

Earnings mean the income of a business after tax. It is the company's profit. Earnings of a company helps to study the company’s performance compared to other players in the market.

Earnings are a critical determinant of share prices. This is so because the earning of the company is either retained (to be ploughed back later into the business) or distributed as dividends to shareholders. Thus, if the average earnings fall below the expected levels, stock prices tend to fall.

Summary

- Earnings mean the income or profit of the business.

- Earnings are essential information that an investor needs because it indicates the cash flow position, ability to pay dividends, expand and grow, meet market risks, etc.

Frequently Asked Questions (FAQs)

What are the standard measures used to assess the earnings of a company?

To gauge a company's performance on the basis of its earnings, the commonly used measures are earnings before taxes (EBT), earnings before interest and taxes (EBIT), earnings before interest, tax, depreciation and amortisation (EBITDA), earnings per share (EPS), price to earnings (P/E) ratio and earnings yield.

What is meant by Earnings Before Taxes?

Earnings before tax are also known as pre-tax income. The value of earnings before tax is found after reducing all expenses from the sales revenue- deductions include the cost of goods sold, salaries, insurance, interest payments, amortisation, depreciation, rent, advertising etc. Thus, earnings before tax indicate the company's profitability without capturing the impact of the nation's tax regime.

© Omidii | Megapixl.com

What is meant by Earnings Before Interest and Taxes?

Earnings before interest and tax are also known as operating income. This is because it is estimated after deducting the operating expenses from the sales revenue. Earnings before interest and tax can also be used as a proxy for cash flow when applied to stable and mature companies whose capital expenditures do not fluctuate excessively. Free cash flow can be found using the earnings before interest and tax value using the following formula-

Free cash flow = EBIT (1- Average tax rate) + Depreciation and Amortisation + Change in non-cash working capital- Capital expenditure.

What is meant by Earnings Before Interest Taxes Depreciation and Amortisation?

Earnings before interest, taxes, depreciation, and amortisation are parameters to assess a company's operating performance. The aim of reducing parameters beyond EBIT is to eliminate the factors that business owners can control- for instance, financing debts, the business's capital structure, methods of depreciating assets, etc. EBITDA emphasises operating decisions because it studies the business's profitability from its core operations before the effect of capital structure, depreciation, amortisation, and leverage. However, this metric is heavily criticised because depreciation is not taken into consideration to assess the earnings. As a result, companies with high depreciation expenses on their capital assets will have to bear this exorbitant cost to keep the work running.

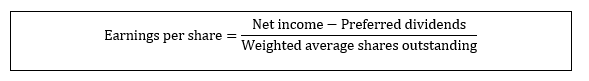

What is meant by Earnings Per Share?

Earnings per share is a financial ratio that indicates a company’s ability to generate profits for common shareholders.

The EPS value of a company in isolation may not give any helpful information – it must be compared with the EPS value of other companies; it also makes sense to study the EPS and the share price, i.e. price to earnings ratio. Two companies operating in the same industry and have a similar number of outstanding shares, higher EPS will imply that the company is more profitable.

If a company's price to earnings ratio is low, it means that shares are cheaper, while if the price to earnings ratio is high, it implies that shares are expensive.

The earnings per share formula is given as follows-

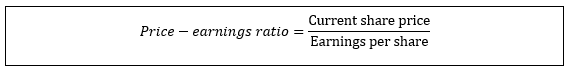

What is meant by Price Earnings Ratio?

Price to earnings ratio is the ratio of the company’s current share price to its earnings per share. Price to earnings ratio indicates how much an investor is willing to invest in one share of a company for its earnings worth US$ 1. For instance, if the P/E ratio is 12, it means that the investors would be willing to pay US$12 for the current earnings worth US$1.

A high price to earnings ratio can mean that the shares are overvalued or that the company is on its growth path. Speculation about future growth can also push up the current prices and thus inflate the price to earnings ratio. On the other hand, a low ratio may be caused due to various types of internal and external risk factors and imply that stocks are undervalued.

Value investing uses the price-earnings ratio concept because it rightly indicates the valuation and thus avoids the risk of a value trap.

© Boris15 | Megapixl.com

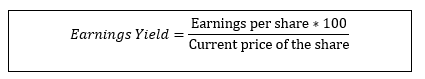

What is meant by Earnings Yield?

Earnings yield is the reciprocal of the price to earnings ratio. The earnings yield helps investors know how much he has earned per share. If a company has an earnings yield of 10%, it means that the investor has earned US$2 for US$20 worth of shares owned.

This data is essential for investors to compare investments made in different companies, not just in stocks, but also in debentures, fixed deposits, etc. Taking the above example as a reference, an investor can make an investment decision by taking the earnings yield of 10% and comparing it against a bond of 5.5% or a fixed deposit of 8%.

What is an earnings report?

A company's earnings report is a periodic document released officially by the company. It aims to bring to the knowledge of various stakeholders the sales, expenses, incomes or profits for a particular period. Thus, sometimes this report is also referred to as an income statement. Stakeholders used the information to assess the financial health of the company. For instance, investors decide whether to invest and how much to invest; creditors can assess the degree of risk in lending to the company; existing shareholders become aware of the extent of profits and, therefore, dividends they can expect. In addition, earnings reports of various periods make the process of comparative analysis easy for stakeholders to assess a company's performance.