ESG Integration

Updated on 2023-08-29T12:02:02.467072Z

What is ESG integration?

ESG integration is the full-fledged inclusion of environmental, social and governance views and initiatives in a business. If one wants their business or investments to be ESG integrated, they have to be more prudent from the ESG angle of evaluation. Embedding ESG into the corporate DNA or investment strategy is called ESG integration. To make a business or a portfolio ESG integrated, one has to Identify ESG risks, make decisions influenced by ESG credentials, implement ESG inclusive policies, incorporate ESG goals even into the executive compensation decision, and ensure that overall strategic objectives are achieved are ESG aligned. ESG integration builds a sustainable business/portfolio and helps manage compliance and regulatory risks. All of this is making more ESG integrated businesses and investment schemes highly popular these days.

Summary

- ESG integration is a strategy to align with environmental, social and governance goals for long-term sustainability.

- ESG integration helps reduce environmental, social, and regulatory risks.

- ESG integration is beneficial not just for corporates but for all its stakeholders.

Frequently Asked Questions (FAQ)

Why is ESG integration important?

- ESG integration and financial motives are guided by the perspective of relevant and material environmental, social and governance factors.

- These non-financial considerations have a significant impact on an entity’s performance.

- Furthermore, with time, more and more stock and bond investors are considering ESG factors in their buy/hold/sell decisions for their portfolio.

- ESG considerations even motivate those investors who want to achieve a positive societal impact.

- Institutional investors are increasingly getting interested in integrated businesses seeing the long-term sustainability benefits.

- ESG integration also helps investors get benefits of long-term returns, brandvalue and decreased investment risk.

- Investor’s reputation remains positive with ESG integrated portfolios.

- Companies are pursuing ESG integration benefit from better employee attraction, retention, engagement, and productivity.

- ESG integration helps satisfy expectations related to ESG compliance.

- ESG integrated businesses remain ethical and responsible, and transparent in the long term.

Image Source: © Kosssmosss | Megapixl.com

What is the process of ESG integration?

To ensure that a business is successfully integrated the following steps can be undertaken-

- Identify existing ESG strengths and conducting a gap analysis for ESG risks is the first step. This includes clearly defining ESG goals for a company and its stakeholders. Clearly defining will help measure performance and identify red flags in this area.

- Next comes analysing the current state of ESG factors or conducting a due diligence around the ESG strategy and risks. The main challenge here is to get clarity on ESG strategies and performance till now. This step essentially helps explore the various solutions one can adopt to achieve a comprehensive ESG approach.

- After this, the business needs to set priorities based on the above analysis and plan accordingly. This means operationalising ESG goals that were abstract and unclear will be converted to concrete and action-oriented ones. Having a complete understanding of ESG goals and gaps enables a company to prioritise which work can be done.

- The ESG priorities determined must align with external ESG standards issued globally by international forums and business councils. While one business may want to monitor greenhouse gas emissions, others may prioritise regulatory approvals. Good governance practices are the base for ESG integration and monitoring.

- Lastly, the business must develop a reporting mechanism for understanding and improving its ESG performance. While many businesses do have ESG metrics for use, it is still a challenging task. Scrutiny of achievements or milestones is essential for ESG integration.

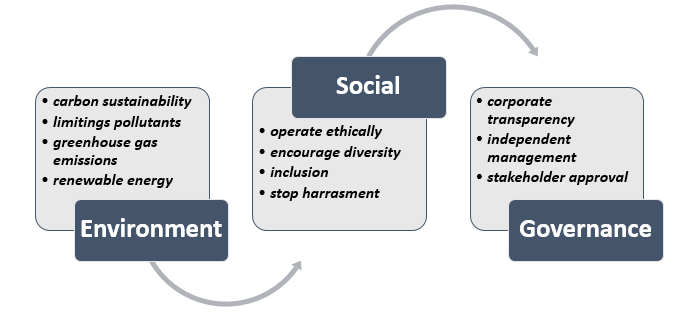

What are the ESG criteria to be considered for integration?

While determining ESG objectives as the first step of ESG integration, a company can consider the following criteria-

Source: Copyright © 2021 Kalkine Media

While determining ESG objectives, the business must keep in mind that -

The company is either reducing its reliance on non-renewable energy or reducing pollution. It can align itself to environmental goals by judiciously using the environmental resources and not exploiting them. It should be able to manage environmental risks well through its ESG policies.

In terms of achieving social objectives, it should become more inclusive and diversified in all its relations with stakeholders. It can also advocate equality through its operations like hiring, wage payment policies, etc. It can also start with a ‘zero’ workplace harassment tolerance policy.

About governance, if the business becomes more transparent and accurate in its reporting and operations, it automatically reduces all governance risks. Another way of doing this is being stakeholder inclusive in decision making. This helps in removing conflicting interests and avoid illegal practices or unfair policies.

Companies cannot achieve all the above criteria in one go. However, it can start with a few. Then, businesses can progress with whichever criteria are more relevant and aligned with their overall objectives.

What are the benefits of ESG integration?

Following are the benefits of ESG integration:

- It improves the company’s performance for the long term. The financial benefits of ESG integration at the company level are reflected in the business's financial performance and valuation.

- ESG integration strengthens chances of sustainable, long-term investment returns by mitigating ESG risks.

- Investment ratings are improved, and it builds a bullish investor sentiment, although not in the short term.

Image Source: © VectorMine | Megapixl.com

- Severe risk incidents are reduced, and ESG integration in an investment portfolio achieves lower return volatility.

- An effective ESG integrated business enhances its brand reputation.

- ESG integration of a business can be a strong motivator for employees wanting to join the company.

- Borrowing becomes easier, and sometimes companies can even avail carbon credits based on their ESG initiatives.

- Consumer sentiments are also increasingly getting affected by ESG concerns. ESG integration can therefore have a positive impact on the top line.

- ESG ratings enable potential investors to filter out such companies for making an investment decision.

- ESG integration has a wider, bigger purpose that is giving back to the stakeholders.