Foreign Direct Investment (FDI)

Updated on 2023-08-29T12:01:08.280930Z

What is Foreign Direct Investment?

A Foreign Direct Investment (FDI) refers to the investment made by a person, firm, and business party in a country, a business or corporation located in another country. When an investor establishes or acquires a business in a foreign company, this investment is called as Foreign Direct Investment.

Source: Copyright © 2021 Kalkine Media

Understanding Foreign Direct Investment

The FDI is an abbreviation of foreign direct investment, which can be described as an investment of a person in a nation into the business in another country with the aim of generating return in long-term. The FDI helps in the economic growth of a targeted country. The FDI can be made by investing in the same or different business in the overseas. There are several agencies that take care of the foreign direct investment and keep insight on the companies.

According to the International Monetary Fund (IMF), FDI only happens when an investor owns 10% or more of a foreign company, if an investor owns less than 10 %, it will be treated as part of their stock portfolio. The FDI directly contribute in the enhancing the living standards in emerging markets.

Frequently Asked Questions (FAQs)

What are the types of Foreign Direct Investment?

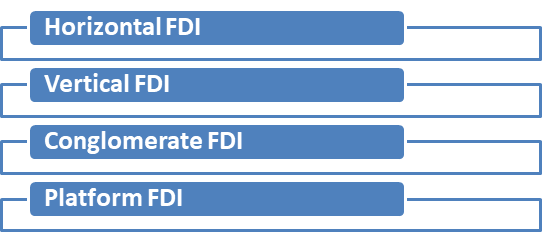

There are four types of foreign direct investments:

Source: Copyright © 2021 Kalkine Media

- Horizontal FDI

Horizontal FDI is one of the most common type of foreign investment. It includes the investment made by an investor in establishing a business in the foreign country as it involves in the home country. When an investor invests in a foreign country to establish the same business he operates in his home country, it is termed as Horizontal Foreign Direct Investment. For instance, ABC is an UK-based automobile company made an investment to open the same business in India.

- Vertical FDI

Under Vertical Foreign Direct Investment, investors put in a different but related business activities business in another country. Usually in vertical FDI, a company invests in the overseas companies, which may supply or sell the related products. The vertical FDI can be categorised into backward vertical integrations and forward vertical integrations. For example, a manufacturing company acquires a foreign company in another country which engaged in supplying raw parts and material.

- Conglomerate FDI

Conglomerate FDI refers to the investments that are made in two different companies of different industries. In this type of investment, an investor puts money in totally different business and sector in foreign country; the business in which an investor invests is unrelated to its existing business in home country. For instance, the FDI is not linked directly to the investors business. For instance, a UK-based manufacturing company invests in the automobile company of another country.

- Platform FDI

In Platform FDI, an investor mane an investment in expanding a business in a foreign country and the goods are manufactured and exported to third country. For example, ABC Company set up its manufacturing plant in UK and exports in India.

What are the advantages of Foreign Direct Investment?

There are several advantages of foreign direct investment:

Economic development: FDI directly helps in the development of a country’s economy by creating favourable environment for investors and companies.

International trade: FDI makes the international trade easier. It involves export or import of goods and services from one country to another.

Providing Employment opportunities: Through FDI, investors establish new companies in foreign country, which creates new jobs and opportunities in a country. This will increase the income and purchasing power, which improve the targeted economy.

Provide Resources: FDI provides different resources by allowing exchange of technology, skills, and other resources.

Enhance productivity: FDI allows transfer of equipment and technology, which directly enhance the workforce’s productivity of the targeted country.

Increase in a country’s income: One of the biggest advantages of FDI is it increases the income of targeted country. National income increases with the creation of job and opportunities that leads economic growth of targeted country.

What are the disadvantages of Foreign Direct Investment?

Political changes: In FDI, investors have to face the risk of political changes. Countries have different governments with different rules and regulation, and these political movements are uncertain which may risk the investment or project in which it has invested.

Restrict domestic investment: Sometimes, FDI can hinder domestic investment. Local companies of a country lose their interest to invest their domestic products because of FDI.

Higher costs: Making an investment under FDI is slightly more expensive for an investor at the time of exporting the products.

How do you keep track on FDI?

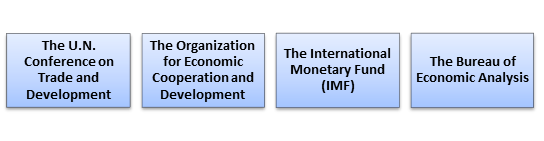

There are various agencies which keeps the track on statistics of the FDI:

Source: Copyright © 2021 Kalkine Media

- The UN Conference on Trade and Development:

The U.N. Conference on Trade and Development is a part of United Nations Secretariat and deals with investment, trade and development issues. The UNCTAD publishes the Global Investment Trends Monitor and sum up FDI trends around the world.

- The Organization for Economic Cooperation and Development

The Organization for Economic Cooperation and Development is intergovernmental economic organization and has 38 countries as its members. The organisation tracks the FDI and publishes quarterly FDI statistics including outflow and inflow.

- The International Monetary Fund

The International Monetary Fund promotes financial stability and global economic growth. In 2010, IMF published Survey of Foreign Direct Investment Positions by covering the positions of 72 countries that was its first of its kind study covering so many nations.

- The Bureau of Economic Analysis

The Bureau of Economic Analysis is a US government agency that reports on the foreign direct investment activities of foreign companies and also provides data of these affiliates that tells how much investment has been made overseas.