Indemnity

Updated on 2023-08-29T12:00:37.177149Z

What is meant by indemnity?

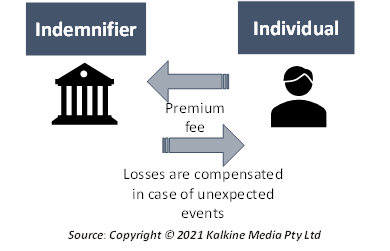

Indemnity refers to the provision under which one party can manage the risk attached to a contract he has entered. Under this provision, the losses suffered by one party are paid for by the other party. An indemnity contract's scope and strength are determined based on how the contract is made and what it entails.

Simply stated, indemnity is the promise by one party to compensate the other party under a contract in case of an unexpected trigger event. This event can include breaching a contract, a party’s failure, or some specific action.

Indemnity can be understood as the transfer of risk between the two parties based on a contract. It can also refer to a legal exemption from paying for damages, wherein the word indemnity has the general meaning of “holding harmless”.

What are the different variations in the meaning of indemnity?

Indemnity may have multiple meanings which change based on the context they are used in. Firstly, indemnity may be used to indicate that an injured individual has the right to claim reimbursement or compensation for the damage suffered by him. This compensation is received from the person in charge as mentioned in the contract.

The second definition of indemnity refers to the compensation offered when there is loss because of the actions of another party.

Finally, the third definition states that the secondary party would compensate the person who bears the losses in case of loss or damages.

How do indemnity clauses work?

The functionality of the indemnity depends highly on how the contract is drafted. However, indemnity may include the following types of coverage:

- All loss: This is broad segregation under which the indemnifying party may be asked to provide coverage in case of all types of unplanned events and they might be asked to compensate the entire amount of loss suffered by the individual.

- A list of loss: This makes the clause more specific and includes a list of instances when the indemnity can be provided. This list may include cost expenses, liabilities, taxes, penalties, etc.

- Direct loss only: This is further narrowing down the contract to only certain specific instances wherein losses are directly incurred by trigger event.

- The most likely loss: The clause may specify what a party may have to pay after the trigger event, excluding rest of the details.

What types of indemnity clauses are there?

The most common types of indemnities include the following:

- Bare indemnities: Under this type of indemnity, the organisation provides complete indemnity to the person who has suffered the damages in case of an unexpected event. All losses and liabilities are compensated by the organisation.

- Limited indemnities: The organisation provides indemnity only against those losses which are not caused by the person himself.

- Party/party indemnities: This is a two-way indemnity wherein the organisation and the individual indemnify each other. The compensation is offered against the losses due to the breach of contract by the indemnifier.

- Reverse indemnities: Unlike limited indemnities, the organisation only indemnifies the individual for the losses that are incurred because of his own actions Thus, this can be considered as the opposite of limited indemnity.

- Third party indemnities: The organisation provides indemnity to the individual against claims by a third party.

- Financing indemnity: Under this, if a third party is unable to fulfil a contract with an individual then the organisation offers to compensate him for the losses incurred.

What are the key aspects to be considered in indemnities?

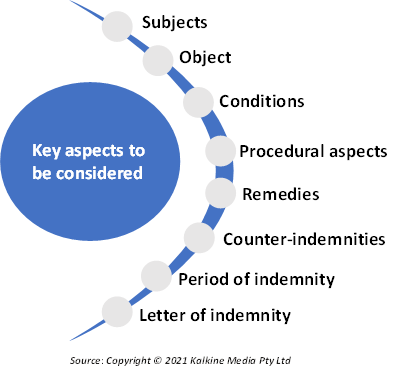

Any indemnification agreement should have the following aspects:

- Subjects: This includes the individuals who are entitled to be indemnified.

- Object: This includes description of the claims and damages that can be reimbursed or compensated and the claims which remain exempted.

- Conditions: These are the conditions for indemnification that specify the level of freedom available to negotiate and maximum amount of indemnity.

- Procedural aspects: This includes the responsibility to take appropriate action depending on the type of situation.

- Remedies: Settlement may be done by means other than financial means.

- Counter-indemnities: Claims that are exempted from the indemnity should be paid for by the individual getting indemnified.

- Period of indemnity: This refers to the time frame till when the indemnity payment structure is applicable.

- Letter of indemnity: This may be included to guarantee that both parties fulfil their end of the agreement.

How a particular indemnity agreement works out depends solely on how each agreement is made and what all is covered in it.

How is indemnity linked to insurances?

An insurance is one of the best examples of indemnity. In an insurance the insurer assumes the risk of the insured party. This transfer of risk is done with an insurance premium in the background. An indemnity clause offered by business may also come with an insurance cover and must be availed by individuals.

Thus, an insurance is an indemnity in which the insurer is paid a premium and promises to pay the insured in case of an unplanned event.

However, it is possible to have an indemnity without an insurance policy. Without an indemnity clause, insurance policies may not have any grounds to hold the insurer liable to pay. Thus, the insurer cannot be asked to repay the insured without a strong indemnity clause in place.

When can indemnity not be applicable?

There are certain instances where indemnification of loss may not be possible. This includes the case when the individual getting indemnified deliberately tries to incur a loss just to receive the compensation. If the unexpected events occur because of the actions of the individual himself then indemnity may sometimes not work.

Indemnity may also not be applicable when the loss is incurred due to some fraud or crime committed by the receiving party. Thus, illegal activities are strictly left out when it comes to providing indemnity. (S