Liquidity

Updated on 2023-08-29T11:56:15.588400Z

What is liquidity?

Liquidity can be described as the degree of ease with which assets or security can be converted into cash. Put on a scale, liquidity is highest when dealing in cash and when an asset goes liquid it means that it is sold in exchange for cash.

Liquidity can at times help facilitating transactions. However, this is swiftly changing as countries adopt digital means of payments.

High liquidity is observed when there exists a lot of financial capital and participation. Other forms of assets often slow down the payment process. The term is also used in accounting to refer to the treasury bills, bonds and assets that can be sold off quicky.

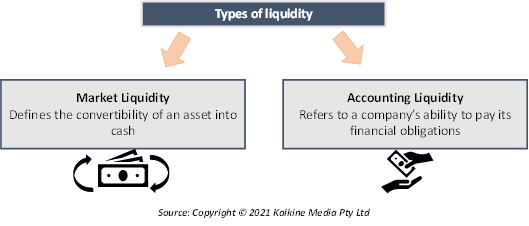

What are the various types of liquidity?

The following are the types of liquidity:

Image Source: © Timbrk | Megapixl.com

- Market Liquidity: This defines the convertibility of an asset into cash and is the most used definition of liquidity. Some of the most liquid assets held by businesses and individuals include savings/money market accounts, stocks traded on major exchanges and ETFs, Government bonds, commercial paper, and other short-term money-market

Illiquid assets include those which can not be easily converted to cash and are usually tangible items like real estate and fine art. Securities that trade on foreign stock exchanges or penny stocks are usually considered illiquid assets.

- Accounting Liquidity: This is the definition of liquidity that is more extensively used in accounts. It refers to a company’s capacity to settle its financial obligations. For individuals, finding out accounting liquidity is assessing their liabilities/debts to the amount of cash held by them.

How is a company’s liquidity measured?

It is essential for companies to keep a track of their level of liquidity. The following ratios can be used by companies to measure liquidity:

- Current Ratio: This ratio is used to compare a company’s current assets against its current liabilities. The ratio can be used to determine whether a company can afford to pay off its short-term debt by using the money that it generated by selling short term assets.

Current assets refer to those assets which are expected to convert to cash within a year’s time and current liabilities refer to a company’s short-term financial obligations that must be paid within the time frame of one year or within a normal operating cycle.

The ratio is measured with the following formula:

- Quick Ratio: The quick ratio formula is similar to the current ratio. However, it only includes those assets which are liquid, such as accounts receivable, cash and bonds/ stocks. It is also known as acid test ratio and is used to check if liabilities can be paid off with quick assets, including assets that can be converted to cash within 90 days.

- Cash Ratio: The ratio is obtained by dividing cash by current This ratio is useful when a firm wants to pay off its debt using just the cash available with it. This is the most tight liquidity ratio and as it excludes inventories, accounts receivable and other current assets.

Under the cash ratio, liquid assets are solely taken as cash and cash equivalents.

What is the importance of liquidity ratios?

Liquidity ratios can be used to understand or access the financial standing of a company. Low liquidity ratios can point to a company having a higher likelihood of default. Therefore, a company is more likely to face a downfall when there is a crisis in the market or when it faces some turmoil.

When the value of the ratio is one, it means that current assets are equal to current liabilities. A value over one indicates that a company has more current assets than it has liabilities. Finally, when the value of the ratio is less than 1 then the company has more current liabilities than current assets and is therefore, in a dangerous position.

There are certain aspects to be kept in mind when ratios are being compared across industries or companies. It is important to compare only those companies that fall within the same industry. Every industry has a different set of liabilities and assets. Operational differences change what liabilities and assets are held by people.

Why is liquidity important in a business?

- Faster transactions: Liquidity helps ensure that the transactions are faster as there is less conversion time needed. Maintaining liquidity is essential for everyday use and to ensure that the value of the asset does not depreciate due to the time taken for conversion.

- Easier selling: It becomes easier to find a buyer when there is a greater degree of liquidity involved. Illiquid assets are usually harder to sell and are generally kept with oneself rather than being traded.

- Maintaining value: Liquid assets retain their value to a large extent. However, illiquid assets generally lose some part of their value when they exchange hands.

How liquid are assets in order?

© Leszekglasner | Megapixl.com

The different assets in one’s balance sheet can be ordered based on their liquidity. This is necessary in finding out how solvent a company is. Here are assets ordered based on their liquidity:

- Cash: Highly liquid as no conversion time is needed.

- Marketable Securities: It can take several days to convert marketable securities into cash.

- Accounts receivable: The liquidity of accounts receivable depends on the company’s standard credit terms. Which may be 90 days or longer.

- Inventory: The liquidity of inventory depends on the turnover level. Additionally, the assets that do not have a resale value also impact liquidity adversely. A discount might be needed to convert the inventory into cash.

- Fixed asset: These require several months to sell and become liquid.

- Goodwill: This can not be converted to cash till the time the company is sold.