Mutual fund

Updated on 2023-08-29T11:58:56.352042Z

What is a Mutual Fund?

A mutual fund is an investment instrument which creates a pool of funds by taking money from several investors and then reinvest the collected amount in the basket of investment opportunities. The basket may consist of securities like stocks, bonds, short-term debts, and other money market instruments of varying companies in the same or different industry group.

In simpler terms, the financial vehicle involves cherry-picking the securities of different asset classes and then bundling them in a single investment group, which is called a mutual fund.

A mutual fund is generally run by the asset management company, where the fund managers professionally manage the funds by researching and investing in different securities and then monitoring the performance.

Significantly, mutual funds offer the diversification opportunity to investors in a convenient manner.

What are the Types of Mutual Funds?

Based on the asset classes, varying types of mutual funds exist in the marker. Some of the major types include:

Growth mutual funds invest in equity securities which are regarded to provide higher returns compared to other asset classes. The investment in equity securities is made depending upon the size of the company. The equity funds which comprise of shares primarily of the small-size companies are regarded to possess an aggressive strategy.

The passive strategy in the equity mutual funds involves investment mainly in the blue-chip stocks. The fund managers may consider price-to-earnings (P/E) ratio, market capitalisation, dividend yield and share price movements before making the investments.

This investment vehicle focusses on generating a fixed stream of income for the investors. The securities in fixed income funds involve debt instrument, government bond and other corporate bonds.

Significantly, different type of bonds have a different degree of risk and return associated with them. While the Government bonds generate low income at low risk, the high-yielding corporate bonds can have a substantially higher risk associated with them.

Index funds are associated with the stock traded index. The funds consist of stocks in the same proportion as that present in the stock index. The focus is to ensure passive investment option to the investors. Owing to limited research and low involvement of the fund manager in managing the funds, such type of funds also has a low maintenance cost.

The money market mutual fund invests in short-term debt securities which are generally considered safe. The Government’s debt obligations and certificate of deposits which have strong financial backing constitute the investment portfolio. The money market funds have a maturity of less than one year.

How does Mutual Funds Work?

Many people want to participate in the stock market, but they might not have substantial interest, knowledge, time, or resources to be involved in tracking the movements of different securities actively.

Mutual Funds here offers a convenient solution to such investors who can buy a portion of mutual funds. This gives them proportional access (in terms of units purchased) to the mutual fund portfolio.

Notably, the investments in mutual funds provide the right to the capital gains of the portfolio. However, investors do not get voting rights. Unlike the stock market, the trading of the Mutual funds takes place at the end of the day after the stock market is closed.

Where is the cost involved in Mutual Funds?

The price of mutual funds is determined using the Net Assets Value (NAV), which represents the fund value per unit. The investors can buy or sell units of the mutual funds at NAV.

The Net Assets Value is inclusive of the management and operational cost incurred by the Asset Management company, along with the proportional value of securities. The additional cost involves advisory fees, administration expenses, legal fees, audit fees, and other cost involved in managing the funds.

The commissions are majorly tied to a type of mutual funds known as ‘load funds’, where the buyers must pay front-load (charged at the time of purchase) or back-load (charged at the time of sale).

There also exist ‘no-load funds’ which do not levy such commission and sales charges.

What are the Types of Returns from the Mutual Funds?

Mutual funds generate income in different ways for the purchaser. These include:

- Dividend Income- The dividend income on the equity shares present in the mutual funds are passed to mutual fund buyers.

- Interest Income- The interest provided by the bond issuer is handed to the investors.

- Capital Gains- When the portfolio manager or asset management company makes a profit on the sale of the securities in the mutual portfolio, it is distributed to the holders of mutual funds share.

- Increase in NAV- It is the increase in the market price of fund shares due to the appreciation in the market value of the securities present in the portfolio. The investors can sell shares to reap the benefit.

The returns on investment are calculated using Absolute Returns, Annualised Return and Compounded Annual Growth Rate.

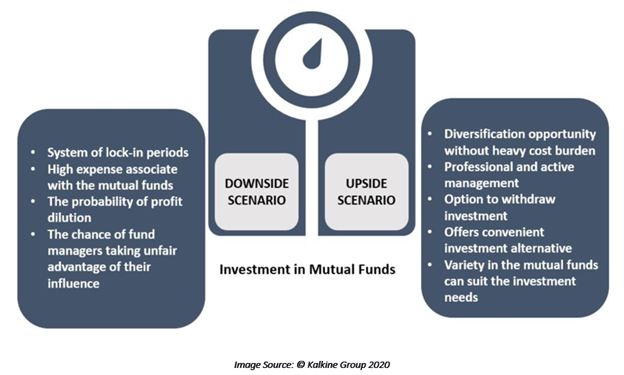

What are the Benefits and Risk of Investing in Mutual Funds?

Benefits

The investment in mutual funds comes with certain benefits. These include:

- Mutual funds provide investors with the opportunity to diversify their investments without incurring substantial cost burden, which is typically associated with diversification in the stock market.

- The funds are professionally and actively managed by the money managers, who have relevant expertise and skills in the field.

- The investors have the option to withdraw their investments at any point. However, the pre-exist penalties and load should be considered before taking up the exit option.

- Investment in mutual funds is a convenient option, especially for those who are interested in passive investments.

- The variety of mutual funds allow investors to select the one that meets one’s priorities, goals, and psychology.

Disadvantages

While the investments in mutual funds sound lucrative, there are varying downsides which should also be considered before investing in the stock market. These include:

- Mutual funds have a system of lock-in periods. The withdrawal of investments in the lock-in periods can levy hefty penalties.

- High expense associate with the mutual funds is another issue which can overall reduce the value of returns.

- The high degree of diversification provided by mutual funds can also lead to a decrease in the profit value (profit dilution).

- The investment in mutual funds gives away the decision-making power to the fund managers. Thus, the chance of fund managers taking unfair advantage of their influence exists concerning mutual funds.