Nasdaq

Updated on 2023-08-29T11:54:50.271319Z

What is Nasdaq?

Nasdaq Stock Market is a global electronic marketplace for buying and selling securities on an automatic, transparent and speedy electronic network. It trades through a computer system rather than in a physical trading floor for the traders to trade directly between them. It is an American stock exchange located in the Financial District of Lower Manhattan in New York City.

NASDAQ is owned by the company Nasdaq. Inc. and ranked second on the list of stock exchanges as per market capitalisation of shares traded. The first rank goes to the New York Stock Exchange. Nasdaq-National Association of Securities Dealers Automated Quotations, was founded in 1971 by the National Association of Securities Dealers (NASD) to avoid inefficient trading and delays. Nasdaq. Inc. company also owns the Nasdaq Nordic stock market network in addition to other exchanges. The exchange has more than 3,100 companies listed. They are the highest trade volume companies in the US market, valued more than US$14 trillion in total.

Good read: NASDAQ surged up above 10,000 – Tech stocks setting a new benchmark

What is Nasdaq known for?

Nasdaq currently is the largest electronic stock market, and it is most well-known for its high-tech stocks. But it also has a variety of companies listed such as capital goods, healthcare, consumer durables and nondurables, energy, public utilities, finance and transportation.

Nasdaq boasts of having some of the largest blue-chip companies in the world and attracts high growth-oriented companies. Its stocks are known to be volatile than those listed on other exchanges. Apart from listed stocks, Nasdaq also trades in over the counter (OTC) stocks. The ticker symbols for the listed companies’ stocks on the Nasdaq have four or five letters.

The Nasdaq Composite index was initially termed as Nasdaq. It included all the stocks listed on Nasdaq stock market and also many stocks listed on Dow Jones Industrial Average and S&P 500 Index. The index has more than 3,000 stocks listed on it which include the world’s largest technology and biotech giants like Microsoft, Apple, Amazon, Alphabet, Facebook, Gilead Sciences, Tesla and Intel.

Did you read: Blue-chip stocks: Value versus Growth in Covid-19 Era

Companies have to meet certain criteria to get listed on the NASDAQ National Market.

- The entities have to meet financial, liquidity, and corporate governance-related requirements.

- Have to get registered with the Securities Exchange Commission (SEC)

- Have to maintain the stock price of at least US$1.

- Company’s value of outstanding stocks must total at least US$1.1 million.

The small companies which cannot meet the criteria can get listed on NASDAQ Small Caps Market. Nasdaq changes the companies as the eligibility of the companies keeps changing.

Image: Kalkine

What are different Nasdaq indexes?

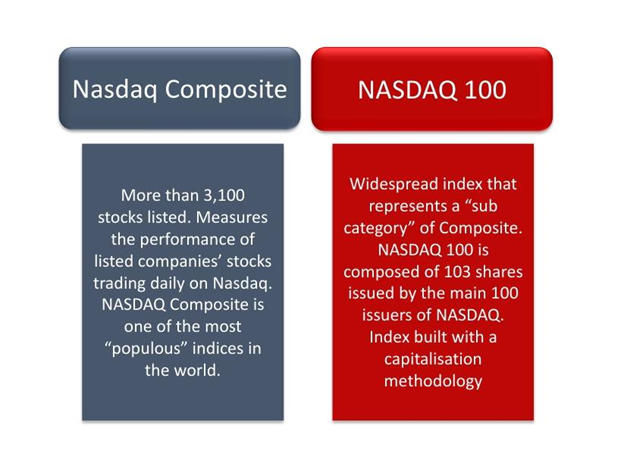

Nasdaq uses an index to list its stocks like any other stock exchange. The index delivers stock performance snapshots. The New York Stock Exchange (NYSE) has the Dow Jones Industrial Average (DJIA) as its primary index; it tracks the stock price of 30 big companies. Nasdaq Composite and the Nasdaq 100 are two indices of Nasdaq. Nasdaq Composite measures the performance of more than 3,100 listed companies’ stocks trading daily on Nasdaq.

Nasdaq 100 is a modified capitalisation-weighted index. This index has listed companies from various sectors, but the majority is from the technology industry. Depending on their market value, Nasdaq adds or removes the companies from its index Nasdaq 100.

Both the NASDAQ Composite and the NASDAQ 100 indexes have listed companies from the United States as well as global companies. On the other hand, Dow Jones Industrial Average index does not include companies outside of the US.

Did you read: Hanging Up Your Boots? Investment Strategies to Help you Relax and Build Wealth

Brief history

Nasdaq performance in the past has been groundbreaking and extraordinary. One of its highly regarded accomplishments is that Nasdaq was the first-ever stock exchange for offering electronic trading. It was the first to launch a website and stored all the records in the cloud. Interestingly, Nasdaq also sold its technology to other stock exchanges. Nasdaq invented the modern Initial Public Offering (IPO) as it listed venture-capital-backed companies.

Initially, it merged with the American Stock Exchange. It formed the Nasdaq-AMEX Market Group, later on, the AMEX index was acquired by NYSE Euronext, and the entire data was integrated into NYSE. In 2007 Nasdaq acquired OMX which is a Swedish-Finnish financial company. Followed by which Nasdaq changed its name to NASDAQ OMX Group. NASDAQ OMX Group bought the Boston Stock Exchange and also the Philadelphia Stock Exchange which was the oldest stock exchange in the US.

Also read: Nasdaq index’s Tech Titans kicks off with Bold Performances

How to trade on Nasdaq?

Though the New York Stock Exchange is the largest exchange by market capitalisation, Nasdaq is the largest by trading volume due to its electronic quote mechanism. Nasdaq is a dealer’s market where the public buys and sells stocks with the help of the market maker (a registered broker/dealer). The market maker provides the buy and sell quotes and takes the position in those stocks.

NYSE works differently as the buyers and sellers can trade directly with each other, and a specialist allows the trade. On Nasdaq, the market maker owns inventory and trade stocks in his/her capacity.

Good read: Why NASDAQ Composite index plunged 5%?