Revenue Bond

Updated on 2023-08-29T11:55:58.921520Z

What is a Revenue Bond?

Revenue Bond is associated with the cash flow of a particular project such as toll, highways, which serves as the collateral against the cash provided to the one who issues the bond. Both public and private sector units can grant such bonds by promising the cash flow from the underlying project as a periodic payment (coupon).

Source: © Rummess | Megapixl.com

In a revenue bond, the refund of the obligation is primarily assured by the operating revenues of an entity. Revenue bonds are mostly utilized by government bodies to subsidize infrastructure projects. These projects often include the construction of airports, roads, bridges, and sewer facilities. Revenue bonds are mostly used by government bodies to subsidize infrastructure projects.

The revenue bonds comprise almost two-thirds of the municipal bonds.

Summary

- Revenue bonds are a class of municipal bond issued to fund public projects which then repay investors from the income created by that project.

- For example, a toll road or utility can be financed with revenue bonds with creditors' interest and principal repaid from the tolls or the fees collected in the process.

- Revenue bonds, unlike the General Obligation (GO) bonds, are project-specific and are not funded by taxpayers.

Frequently Asked Questions (FAQs)

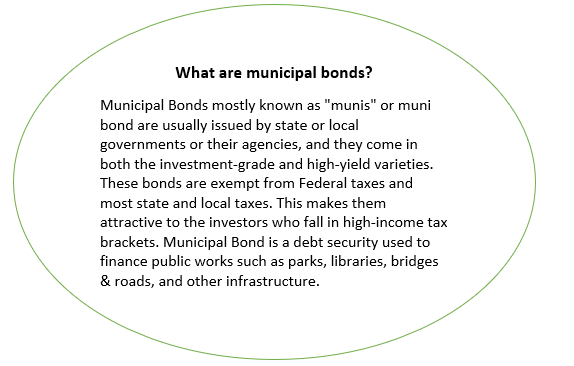

What are Municipal Bonds?

So, if investors are willing to invest in revenue bonds, then there are a lot of options available in the market. Noticeably, before investing, the investors must examine the viability of the underlying project to save themselves from the instances of credit default. Revenue bonds are considered because repayment depends on specific revenue streams, such as user fees or lease payments. The government or corporation that issued the bonds for the corporations has no legal duty to repay the debt if the institution goes bankrupt and is unable to fulfil its debt obligations.

For example, Michael invests in fixed-income securities. He discovers that the local municipality aims to earn US$7 million by issuing revenue bonds to subsidise the construction of a new highway. Michael analyses the project and reaches a conclusion that the new highway will facilitate transportation between the two adjacent cities. Thus, after he is confident that this project will generate sufficient revenues streams, he decides to buy the bonds. The bonds come with a face value of US$1,200, a maturity of 30 years, and an interest rate is 1.5 percent. The interest and principal repayments are secured by revenues that will be collected by tolls when the construction is finished.

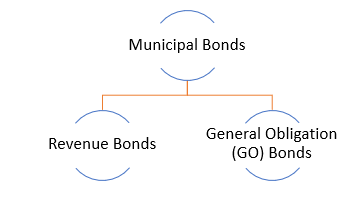

Types of Municipal Bonds

Municipal bonds are of two types: Revenue bonds and general obligation bonds.

Source: Copyright © 2021 Kalkine Media

What is the difference between Revenue Bond and General Obligation (GO) bond?

Notably, there is a lot of difference between the two municipal bonds -- Revenue Bonds and General Obligation (GO) Bonds. The aforesaid bonds differ in the sources of cash flows that will be responsible for repaying the investors who provide the capital to issue the bonds. The repayment of GO bonds is secured by all the revenues collected by an entity, including their tax revenues, whereas the reimbursement of revenue bonds is guaranteed only by revenues received by the projects subsidized using the bonds. Tax revenues are not used at all. General obligation bonds are considered much safer as compared to revenue bonds.

What is the structure of a Revenue Bond?

Investors can buy a revenue bond by paying the face value amount of the bond and, in return, they are paid interest during the life of the bond. As the bond matures, the face value amount is returned to the investor given that there was sufficient revenue from the project to repay the bond. If the revenue generated from a project is not sufficient then the investors are likely to lose their total investment.

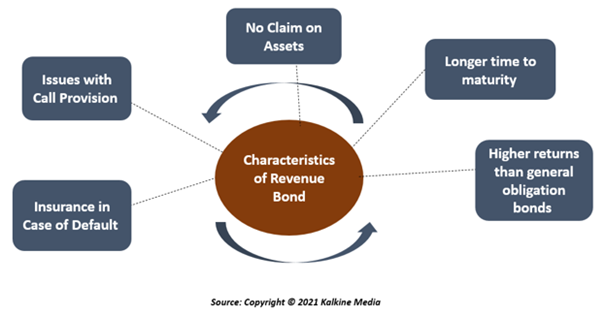

What are the Characteristics of the Revenue bonds?

- Longer Time to Maturity

Since revenue bonds are not used for short-term projects, they feature long maturities. Mostly, the maturity dates of the bonds often vary from 20 to 30 years. Besides, they come with a face value of US$1,000 or US$5,000. Therefore, operating revenues of a project are used to make both the interest and the principal payments. In case a project fails to produce enough revenues to make the payments, the payments can be postponed.

- Higher Returns than General Obligation Bonds

As compared to GO bonds, revenue bonds often provide higher returns to the investors. The higher returns can be justified for various grounds. First, there are more chances of non-repayment because they are only secured by the revenue streams generated by a project. Not only this, if a project fails to raise the expected revenues, these bonds do not provide investors the right to stake their claim on the assets of the said project. Furthermore, the bonds mostly incorporate provisions stating that the issuers may call the issued bonds if the project’s assets are destroyed in disastrous events.

- No Claim on Assets

The bond buyers cannot stake claim on the assets of the projects. If the projects turn out to be unsuccessful, bondholders are not allowed to repossess the toll roads or equipment.

- Issues with Call Provision

Revenue bonds are issued with a catastrophe call provision, which means that the issuer has a right to call back the bonds if the revenue-producing facility is destroyed. Callable bonds mean higher risk for investors. If the bonds are repurchased, the investors will lose some future interest payments, which is also known as refinancing risk.

5 Insurance in Case of Default

Revenue bonds are more vulnerable to credit, interest, call, and market risks. The issuer often provides insurance on their bonds to prevent defaulting on its obligation.

What are different types of Revenue Bonds?

- Industrial revenue bonds fund public projects like parks, the stadium they will generate usage feed when booked for concerts, sports events, meetings. Airport revenue bonds involve funding the construction of airports, landing fees, fuel fees, lease payments to secure the bonds.

- Public utility revenue bonds are funded through the sale of electricity.

- Hospital revenue bonds involve funding hospital construction, renovation, and purchase of medical equipment. Highway revenue bonds used to build revenue-producing facilities such as bridges and toll roads. Transportation revenue bonds are issued to finance local public transportations such as buses, subway systems.

- There is another category called “essential services” revenue bonds. This category includes projects related to water, sewer, and power systems. Revenue from such projects is considered more reliable. Non-essential services revenue bonds pose greater risks than bonds financed by revenue from essential services.

How to analyze Revenue Bonds?

Always check out the specifics of the security. To determine the safety of a revenue bond, one might want to see whether it has a credit enhancement, which provides a certain degree of safety. For this purpose, we can also look at the call features. One can assume that if a bond is callable, it has a higher yield than a non-callable bond because the investor is taking more risk.

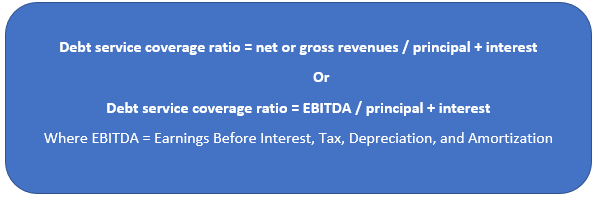

The debt service coverage ratio is an indication of the ability of a bond issuer to meet the debt service payments on its bonds. The higher the debt service coverage ratio, the more likely the issuer is to be able to meet interest and principal payments on time.

Use the following formula to answer it.

What are the advantages of Revenue Bonds?

- An advantage of investing in revenue bonds is that interest income is usually immune from federal, state, or local taxes. It thus profits those investors who have a high-income tax bracket. That is the reason, it is famous in high tax rate states.

- Revenue bonds are seen as safer as compared to the corporate bonds.

What are the risks associated with the purchase of Revenue Bonds?

Since they are not supported by the full faith and credit of the municipality, they are liable to higher default risks as compared to GO bonds.

- Inflation negatively impacts return from the revenue bond

Rise in price or inflation drastically affects the returns generated from the revenue bonds. Though, variable-rate revenue bonds do provide some protection against inflation.

- Tax Exemption Advantage can be quashed

Pending tax related laws can impact the value of revenue bonds if the state or federal tax rate is decreased. This means, these bonds provide maximum profit to the high tax environment where a high tax bracket investor gets the advantage of tax exemption. Further, these tax exemption advantages provided to revenue bonds can be cancelled by an IRS.