Ulcer Index (UI)

Updated on 2023-08-29T11:55:51.681336Z

What is Ulcer Index?

Ulcer Index (UI) measures the downside risk of an investment from two aspects, the duration within which price declines and the depth of the decline. It is a technical indicator that increases in value when the prices start moving away from the recent high and falls in value when the prices reach a new high. The calculation of the indicator takes place within the time span of 14 days. The indicator projects the percentage value that can be interpreted as the drawdown that a trader might expect within that period from the high.

If the percentage value of Ulcer Index is high, then it means that the stock will take a long time to get back to its recent high.

In brief, Ulcer Index is designed to measure the volatility only from the downside.

Highlights

- Ulcer Index (UI) measures the downside risk of an investment from two aspects, the duration within which price declines and the depth.

- UI is a technical indicator that increases in the value when the prices start moving away from the recent high and UI falls in value when the prices reach a new high.

- If the percentage value of Ulcer Index is high, then it means that the stock will take a long time to get back to its recent high.

Frequently Asked Questions (FAQs)

What is the history of the Ulcer Index?

In 1987 the Ulcer Index was introduced by Byron McCann and Peter Marin with the aim to assess mutual funds. The Ulcer Index was published in 1989 in the book of McCann and Marin. The title of the book was “The Investor’s Guide to Fidelity Funds”. The technical indicator does not project the overall volatility but only the downside risk.

Usually, the investor does not consider the upside risk and gives a considerable amount of importance to the downside risk, and it can cause stomach ulcer and stress, as the name suggests.

What are the calculations for Ulcer Index?

The calculations of the Ulcer Index indicate the volatility within the financial asset which is dependent upon the depreciation of the security prices over a specific duration. The index values become zero when the security prices reach a new high at closing. The zero value can be interpreted as the presence of no downside risk as the security prices are rising consistently. However, it does not indicate that prices have not reduced for a long time and showed a continuous upward trend.

The calculation of the Ulcer Index is done for a period of 14 days.

The investor will observe an increase in the value of the Ulcer Index when the gap between the recent high and current prices increases and the UI value will decrease when the prices show a bull trend. To summarise, the higher value of the Ulcer Index means that the share will take more time to reach its previous high.

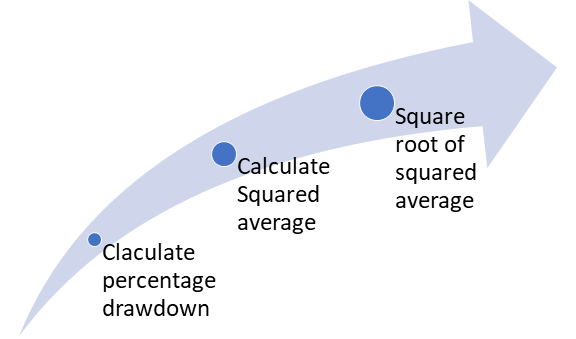

The calculation of the Ulcer Index is done in three steps:

- Firstly, the percentage drawdown is calculated by subtracting the closing price from the former highest close within the 14 days, dividing it with the latter and then multiplying the whole with 100.

- Secondly, the squared average is calculated by taking the squared sum of drawdown and dividing by 14.

- Lastly, the square root of the squared average is ascertained to get the value of the Ulcer Index.

How is Ulcer Index used?

The usage of the Ulcer Index is not complicated. To begin with, the investor must ensure that the UI is built-in in the charting platform. Generally, platforms like MT4 do not have UI built-in and the investor is required to download it and then install the same.

After that, the investors are required to verify the period by going to the settings and checking the period. By default, the period is generally 14 days, but the investor can modify the same as per their investment strategy.

Two lines will appear on the screen as the app is launched. One line will be continuous and the other will have 2 colours. These lines are generally the signal of the indicator.

Unlike other indicators, the UI is only helpful when the prices of the financial assets are moving in an upward direction. The two lines will appear hovering around the center line.

Moreover, Ulcer Index should not be used by the day traders and is most suitable for long-only traders because prices will reach zero when prices are moving upward to reach new heights.

What advantages are associated with Ulcer Index?

By using Ulcer Index the investors can focus on the downward risk that is associated with investing in a particular security.

Let’s understand the advantages with the help of examples. The standard deviation shows the shift in the prices, both upwards and downward. Suppose there is a security with a standard deviation of 10%, and this 10% impacts the whole value (irrespective of the direction of the movement). But in the case of the Ulcer Index, the value of 10% indicates that prices have moved down by 10% and the investor will give more importance to the direction as the upward movement is not a disappointing factor. Thus, standard deviation only indicates the variance but not the actual impact of the value.

Moreover, Ulcer Index is efficient in scanning and sorting the high volatility securities. The scan will help in sorting those securities that are showing an upward trend followed by another scan that will sort the securities that have a high amount of volatility.

What is the Ulcer Performance Index?

Alternative to the Ulcer Index is the Sharpe Ratio which helps in ascertaining the risk-adjusted returns by subtracting the total returns from the risk-free return and then dividing it by standard deviation. However, it has been observed that standard deviation is not utilised or prioritised by the investors. Therefore, the Ulcer Performance index was introduced that replaced standard deviation with the Ulcer Index. The Ulcer Performance Index helps in ascertaining the risk-adjusted returns and the higher the value, the better it will be for the long-term investors.