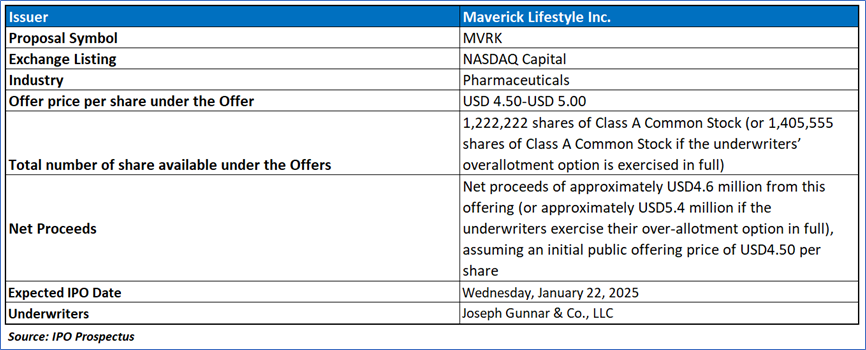

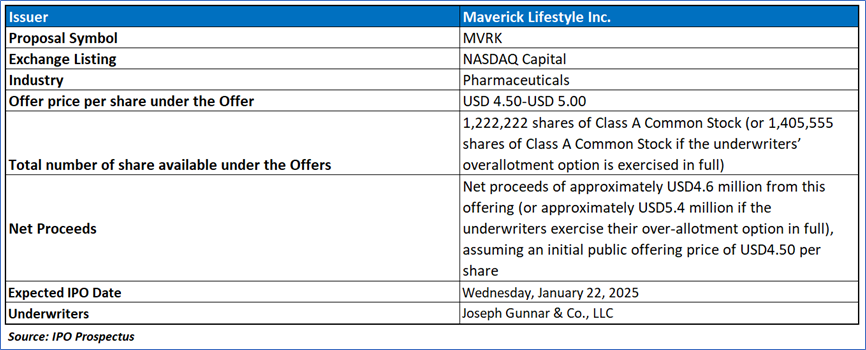

The Offer

Company Overview

MVRK, a Hemp Canna-Infused Products Company, specializes in manufacturing, branding, and distributing hemp-derived cannabinoid products such as pre-rolled joints, cigarettes, vapes, gummies, and edibles, all compliant with federal regulations. The company also develops high-speed rolling technology tailored for the hemp and cannabis industry, enhancing production efficiency. Founded in 2019, MVRK aims to offer affordable, legal alternatives to tobacco and cannabis, leveraging its BLAZ brand to attract both traditional and new consumers. Despite growth, the company faces financial challenges, having incurred significant net losses and operating with a limited history, leading to doubts about its long-term viability.

Key Highlights

Primary Offering:

The total number of 1,222,222 shares of Class A Common Stock (or 1,405,555 shares of Class A Common Stock if the underwriters’ overallotment option is exercised in full)

Use of proceeds:

MVRK plans to allocate the net proceeds from this offering as follows:

- Approximately USD 2.1 million will be allocated to marketing and advertising initiatives.

- Around USD 0.5 million will be used for the recruitment of key personnel.

- Approximately USD 0.1 million will be invested in upgrading machinery.

- The remaining funds will be utilized for working capital.

Dividend policy:

MVRK has never declared or paid any cash dividends on its capital stock. The company currently intends to retain earnings, if any, to finance the growth and development of its business. MVRK does not anticipate paying any cash dividends on its common stock in the foreseeable future. The payment of future dividends, if any, will be at the discretion of the board of directors and will depend on the company's financial condition, results of operations, capital requirements, restrictions in any financing instruments, provisions of applicable law, and other factors deemed relevant by the board.

Market Opportunity and Growth Strategy for MVRK:

- Target Market and Industry Overview: MVRK focuses on consumers of both tobacco and cannabis products in the United States. The U.S. tobacco market, valued at $75.9 billion in 2021, is complemented by the rapidly growing U.S. legal cannabis market, which is worth $16.1 billion annually and expanding at 30% per year. The market for combustible products includes traditional cigarettes, cigars, electronic vapes, and hemp products. While cigarettes dominate the global tobacco sales, with 75% of the market share, there is a growing interest in alternatives. The pre-rolled cannabis product market, particularly in states where cannabis is legal, has seen a 38% growth in 2021, reflecting increasing consumer demand for convenient, ready-to-use products. The hemp smokables market, including products like delta-8-THC, delta-10-THC, and HHC, is poised for significant expansion, especially in regions where recreational cannabis is still prohibited.

- Market Trends and Consumer Behavior: The alternative cannabinoid market, while diverse, has fewer competitors in the combustible sector, with MVRK positioned as one of the key players. Smoking hemp is becoming more socially accepted, and consumers are increasingly viewing it as a viable alternative to traditional tobacco and cannabis products. A report by Hemp Industry Daily revealed that tobacco smokers are 191% more likely to use hemp pre-rolls compared to the general population, with approximately 29% of cigarette smokers expressing interest in smokable hemp. MVRK aims to tap into this growing market by offering hemp products that are nicotine-free, tobacco-free, and cannabis-free, catering to consumers seeking organic and legal alternatives to tobacco and cannabis.

- Strategic Focus and Growth Potential: MVRK’s strategy focuses on capitalizing on the increasing demand for smokable hemp and cannabis-like products by offering a unique, non-nicotine and non-tobacco alternative. The company believes its manufacturing capabilities will allow for attractive margins on both proprietary and white-label products. With significant manufacturing capacity, MVRK can cater to the growing demand for hemp products, drawing other brands to partner for white-label business opportunities. This approach not only positions the company to benefit from the rising trend of smokable hemp but also enhances revenue streams through its large-scale production capacity.

Financial Highlights (Results of Operations) (Expressed in USD)

- Product Sales Overview: MVRK’s product sales for the nine months ended September 30, 2024, amounted to USD 2,350,294, a notable increase from USD 1,556,990 in the same period in 2023. The growth in sales during 2024 was primarily driven by higher revenue from the DVNT product line and increased private label sales. For the period ending September 30, 2024, blunts accounted for approximately 59% of total revenue, while pre-rolls represented 20%, flower 16%, and vapes and gummies 3%. This year, the DVNT brand contributed 66% to revenue, with private label brands making up 33%. In comparison, for the same period in 2023, blunts contributed 51% and pre-rolls 34%, with other product lines contributing smaller portions. The significant growth in revenue distribution reflects strong demand for MVRK's blunts and the growing popularity of the flower segment.

- Cost of Sales and Depreciation: The cost of sales for the nine months ending September 30, 2024, totaled USD 845,832, compared to USD 502,168 during the same period in 2023, marking an increase of USD 343,664. This rise is largely due to higher production costs associated with the DVNT product line, particularly the hemp raw material costs. MVRK’s cost of sales includes hemp material, packaging, manufacturing, machine costs, maintenance, and distribution fees. Depreciation for the nine months ended September 30, 2024, amounted to USD 557,626, a decrease from USD 1,126,047 in 2023. The reduction in depreciation is attributed to a change in the estimated useful life of manufacturing equipment, from seven years to ten years, effective July 2023, which led to a significant decrease in depreciation expenses.

- General and Administrative Expenses: General and administrative expenses for the nine months ended September 30, 2024, were USD 1,008,288, reflecting a 36% increase from USD 644,889 in 2023. The rise was primarily due to an increase in audit fees, which grew by USD 301,417, and an increase in salaries, which added USD 87,618 to expenses. Despite the rise in expenses, MVRK's loss from operations decreased substantially, from USD (716,114) in 2023 to USD (61,452) in 2024. The reduced loss was primarily driven by higher sales from the DVNT product line, though offset by increased administrative costs.

- Financial Position and Liquidity: As of September 30, 2024, MVRK had cash of USD 155,298 and a working capital of USD 723,120. The company has historically funded its operations through product sales and equity and debt financing. Despite incurring an accumulated deficit of USD 8,260,221 since inception and not yet achieving significant profitability, MVRK is optimistic about improving its financial position as it continues to refine its business model. The company's future operations depend on its ability to secure additional financial support and raise necessary capital to fund ongoing growth. MVRK anticipates positive cash flow and operational improvements in the near future, contingent on successful capital raising and operational performance.

- Convertible Loan and Debt Obligations: MVRK is currently engaged in a convertible loan agreement with BH Group, LLC, for a principal amount of USD 8.05 million. The loan, which is secured by a first lien on the company’s assets, may be converted into common stock at the lender’s discretion, upon the completion of MVRK's public offering. The loan maturity has been extended to March 2026, and MVRK has amended the payment schedule. The company does not intend to use the proceeds from its current offering to repay this loan but instead aims to secure sufficient funds for growth and operations. The outstanding debt obligations represent a key risk to the company’s liquidity and future operational flexibility, and MVRK is actively seeking additional capital to continue its expansion.

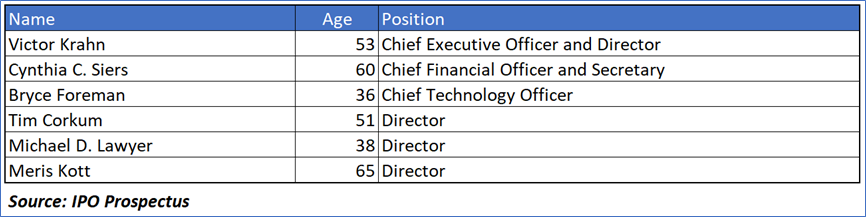

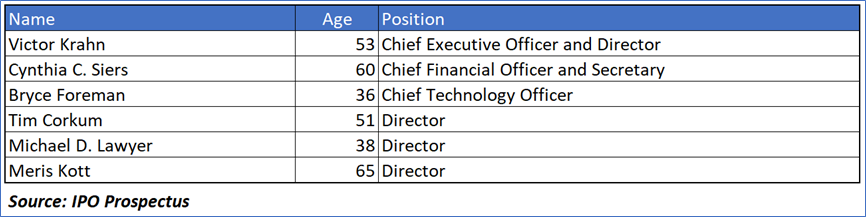

Key Management Highlights

Risk Associated (High)

Investment in the IPO of “MVRK” is exposed to a variety of risks such as:

- Going Concern Doubts: MVRK has accumulated a deficit of USD 8.26 million and has raised substantial concerns about its ability to continue as a going concern. Despite plans to raise capital through offerings, there is no assurance that these plans will succeed, which may further jeopardize its business continuity.

- Regulatory and Legal Challenges: MVRK’s operations, particularly in the hemp smokables industry, are highly dependent on navigating complex and evolving federal and state regulations. Any misinterpretation of the 2018 Farm Bill or violations of state laws could lead to severe legal consequences, including penalties, operational shutdowns, or asset seizures. Additionally, variations in state laws and frequent regulatory changes increase compliance risks and costs.

- Product Health and Safety Concerns: MVRK’s products, especially in the vape segment, face significant public health scrutiny due to potential long-term health risks associated with e-cigarettes and vaping. If further research links vaping to serious health issues, it could result in decreased consumer demand and adverse regulatory actions, negatively impacting the business.

Conclusion

MVRK, a company specializing in hemp-derived cannabinoid products, has experienced growth in sales and expanding product offerings, including its DVNT brand. However, its financial position remains a concern, with an accumulated deficit of USD 8.26 million and doubts about its ability to continue as a going concern. Despite plans to raise capital, the company faces significant risks related to regulatory uncertainties and legal challenges, particularly with varying state laws surrounding hemp and cannabis. Additionally, the health risks associated with its vape products could lead to adverse consumer perceptions and regulatory scrutiny. Given these challenges, the IPO carries substantial risk, and potential investors should weigh the company's growth potential against its financial instability and regulatory hurdles.

Hence, given the financial performance of the company, use of proceeds, and associated risks “Maverick Lifestyle Inc. (MVRK)” IPO seems “Neutral" at the IPO price.

Disclaimer-

This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

Choosing an investment is an important decision. If you do not feel confident making a decision based on the recommendations Kalkine has made in our reports, you should consider seeking advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice. The information in this report does not constitute an offer to sell securities or other financial products or a solicitation of an offer to buy securities or other financial products. Our reports contain general recommendations to invest in securities and other financial products.

Kalkine is not responsible for, and does not guarantee, the performance of the investments mentioned in this report This report may contain information on past performance of particular investments. Past performance is not an indicator of future performance. Hypothetical returns may not reflect actual performance. Any displays of potential investment opportunities are for sample purposes only and may not actually be available to investors. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services..

Please also read our Terms & Conditions and Financial Services Guide for further information. Employees and/or associates of Kalkine and its related entities may hold interests in the securities or other financial products covered in this report or on the Kalkine website. Any such employees and associates are required to comply with certain safeguards, procedures and disclosures as required by law.

Kalkine Media Pty Ltd, an affiliate of Kalkine Pty Ltd, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website including entities covered in this Report.

AU

Please wait processing your request...

Please wait processing your request...