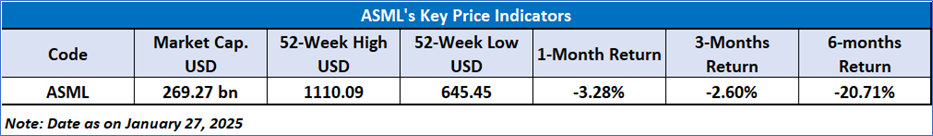

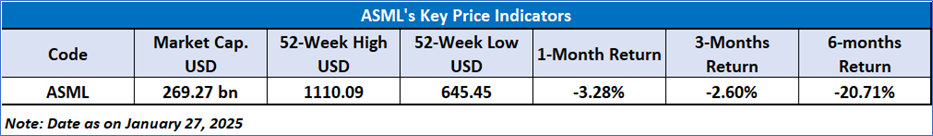

ASML Holding N.V

ASML Holding N.V. (NASDAQ: ASML) is a semiconductor producer that provides various wafer fabrication services and technologies. The company manufactures a wide array of semiconductor devices, such as microprocessors, mobile application processors, baseband processors, network processors, radio frequency modems, microcontrollers, and power management units.

Recent Business and Financial Updates

- Q3 FY24 Financial Results: ASML reported net sales of €7.5 billion for Q3 2024, exceeding its initial forecast. This strong performance was mainly driven by robust sales of Deep Ultraviolet (DUV) lithography systems and Installed Base Management, resulting in a gross margin of 50.8%, within expectations. The company achieved net income of €2.1 billion and earnings per share (EPS) of €5.28, demonstrating solid profitability. Net bookings totaled €2.6 billion, with €1.4 billion from Extreme Ultraviolet (EUV) sales.

- Q3 FY24 Performance Breakdown: ASML sold 106 new lithography systems in Q3 2024, up from 89 in Q2 2024, and 10 used systems, a slight decrease from 11 units in the previous quarter. Installed Base Management sales grew slightly to €1.54 billion, from €1.48 billion in Q2. Gross profit increased to €3.79 billion, compared to €3.21 billion in Q2, reflecting stable margins despite market challenges.

- FY25 Outlook: ASML expects net sales for 2025 to range from €30 billion to €35 billion, with a gross margin between 51% and 53%. This forecast is lower than previous projections due to delayed EUV demand. The company anticipates a gradual market recovery in 2025, with cautious customer sentiment amid current market conditions.

- Full-Year 2024 Guidance: ASML has revised its 2024 net sales outlook to around €28 billion, reflecting continued growth despite market uncertainty. The company remains optimistic about artificial intelligence (AI), though recovery in other market segments, such as the logic market, is slower than expected due to competitive foundry dynamics, resulting in production delays and changes in EUV lithography demand.

- Dividend and Share Buyback: ASML declared an interim dividend of €1.52 per share, payable on November 7, 2024. The company did not repurchase any shares in Q3 2024 under its 2022-2025 share buyback program but remains committed to returning value to shareholders despite current market conditions.

- Strategic Growth: ASML updated its long-term strategy, forecasting annual revenue between €44 billion and €60 billion by 2030, with a gross margin expected between 56% and 60%, driven by global market trends and technological advancements..

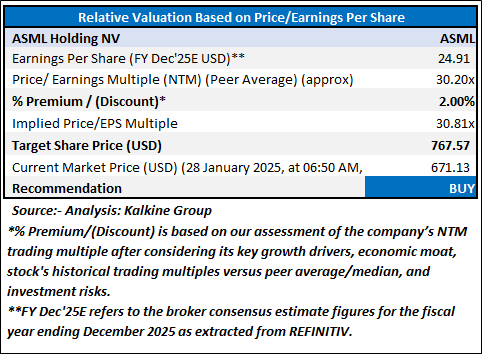

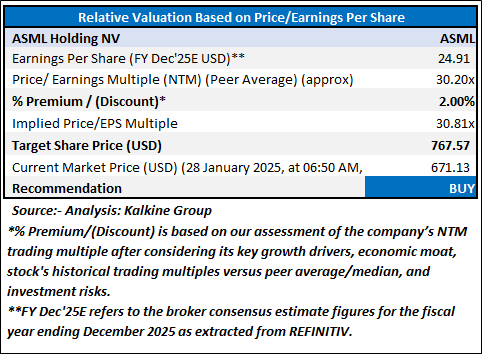

Valuation (using P/E Multiple):

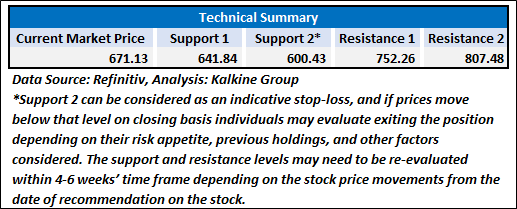

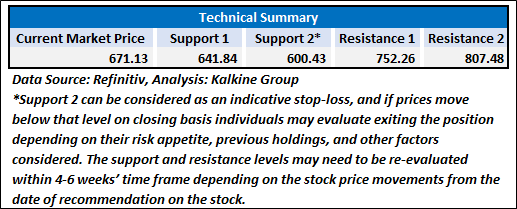

Technical Observation (on the daily chart):

ASML's stock price is nearing critical support levels, indicating a potential reversal that could lead to an upward movement. The 14-day Relative Strength Index (RSI) is currently under the neutral midpoint, implying that a positive shift may be imminent. Moreover, the 50-day Simple Moving Average (SMA) is situated above the current stock price, and it's expected that as the stock price approaches this level, the 50-day SMA will likely act as support, enhancing buying interest in the stock.

As per the above-mentioned price action, recent key business and financial updates, and technical indicators analysis, a ‘Buy’ rating has been given to ASML Holding N.V (NASDAQ: ASML) at the current market price of USD 671.13 as of January 28, 2025 at 06:50 AM PST.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is January 28, 2025. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...