Broadcom Inc.

Broadcom Inc. (NASDAQ: AVGO) is a worldwide technology firm that designs, develops, and provides a wide array of semiconductors, enterprise software, and security solutions. The company operates in two main segments: semiconductor solutions and infrastructure software.

Recent Business and Financial Updates

- Q4 FY24 and Fiscal Year 2024 Performance: Broadcom Inc. announced a robust performance for the fourth quarter of fiscal year 2024, with total revenue reaching $14,054 million, a 51% increase compared to the same period last year. The company also reported a GAAP net income of $4,324 million for the quarter, while non-GAAP net income surged to $6,965 million. Adjusted EBITDA for the fourth quarter was $9,089 million, representing 65% of revenue. The GAAP diluted earnings per share (EPS) stood at $0.90, while non-GAAP diluted EPS was $1.42.

- Impressive Growth in Revenue and Profitability: For the fiscal year 2024, Broadcom achieved a record revenue of $51.6 billion, a 44% year-over-year increase. This was driven by strong growth across both its semiconductor and infrastructure software segments. The semiconductor business generated $30.1 billion, with AI revenue increasing by 220% to $12.2 billion, reflecting the success of Broadcom's AI XPUs and Ethernet networking products. Infrastructure software revenue reached $21.5 billion, bolstered by the integration of VMware.

- Record-Setting Cash Flow and Free Cash Flow: In terms of cash flow, Broadcom generated $5,604 million from operations during Q4, a 16% increase from the previous year. Capital expenditures amounted to $122 million, resulting in free cash flow of $5,482 million, or 39% of revenue. For the fiscal year 2024, the company reported free cash flow of $21.9 billion, underlining its strong financial position.

- Dividend Increase Reflects Strong Financial Health: Broadcom’s strong cash flows enabled the company to increase its quarterly common stock dividend by 11%, raising it to $0.59 per share for the fourth quarter. The increase marks the company’s 14th consecutive year of dividend hikes. Based on the improved cash flow performance, Broadcom has set a target annual dividend of $2.36 per share for fiscal year 2025, a record for the company.

- Segment Performance and Growth Drivers: Broadcom’s semiconductor solutions segment generated $8,230 million in revenue for the fourth quarter, growing 12% year-over-year, while infrastructure software revenue soared by 196% to $5,824 million, reflecting the successful integration of VMware. For the fiscal year, semiconductor solutions revenue increased by 7%, and infrastructure software revenue grew by 181%, contributing significantly to the overall revenue growth.

- Guidance for Q1 Fiscal Year 2025: Looking ahead, Broadcom expects revenue for the first quarter of fiscal year 2025 to be approximately $14.6 billion, representing a 22% increase from the same period last year. The company also projects adjusted EBITDA to be around 66% of the expected revenue for the quarter. Broadcom has refrained from providing a detailed reconciliation of projected non-GAAP financial measures to GAAP, given the complexity of the estimation process.

- Quarterly Dividend Declaration: Broadcom’s Board of Directors has approved a quarterly cash dividend of $0.59 per share, payable on December 31, 2024, to stockholders of record as of the close of business on December 23, 2024. This dividend increase demonstrates the company’s continued commitment to returning value to shareholders while maintaining strong financial performance.

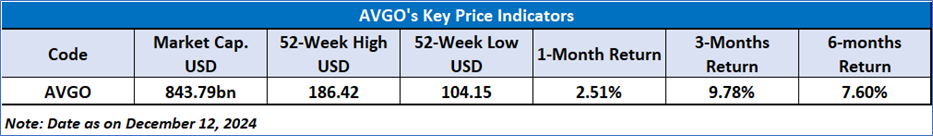

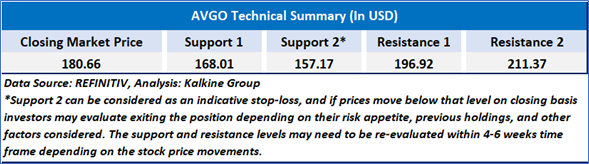

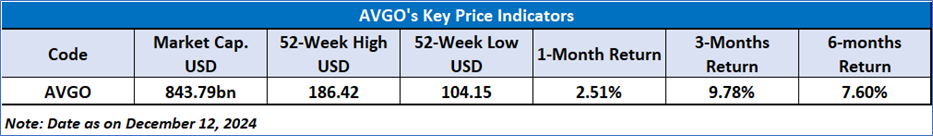

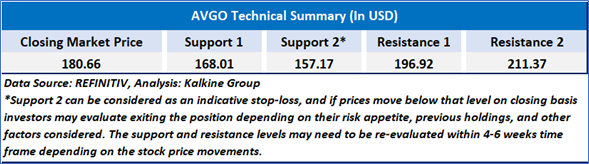

Technical Observation (on the daily chart):

Broadcom Inc. (AVGO) is currently in a strong uptrend, trading around $180.66, above key moving averages (MA 21 at $169.16 and MA 50 at $173.90), indicating bullish momentum. The RSI is at 59.33, suggesting there is still room for growth without being overbought. The higher volume in recent months supports the upward price movement, and as long as the stock stays above the 50-day moving average, the bullish trend is likely to continue.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is December 12,2024. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...