Barrick Gold Corporation

Barrick Gold Corporation (NYSE: GOLD) is a Canadian company specializing in gold and copper production. It is involved in the extraction, sale, and related operations, including exploration and mine development.

Recent Business and Financial Updates

- Gold and Copper Production Overview: Barrick Gold Corporation has announced its preliminary production and sales results for the third quarter of 2024. The company reported gold production of 943 thousand ounces and copper production of 48 thousand tonnes. Gold sales for the quarter totaled 967 thousand ounces, while copper sales amounted to 42 thousand tonnes. Barrick remains on track to achieve its full-year production guidance, anticipating a significantly stronger performance in the fourth quarter.

- Gold Production Performance: Preliminary gold production in the third quarter remained consistent with the second quarter. The Pueblo Viejo mine achieved a 23% sequential increase in production, benefiting from ongoing plant optimization. North Mara delivered a stronger performance due to higher grades, while Carlin saw operational improvements following the Gold Quarry roaster expansion, completed during a planned shutdown. Turquoise Ridge improved quarter-over-quarter, with robust underground mining activity compensating for the planned Sage autoclave shutdown. Kibali also advanced underground development, accessing higher-grade ore, which, along with higher open-pit grades and volumes, is expected to drive improved results in the fourth quarter.

- Gold Cost Metrics: Compared to the second quarter, the company expects gold cost of sales per ounce to be 1% to 3% higher. Total cash costs per ounce are projected to rise by 3% to 5%, while all-in sustaining costs per ounce are anticipated to increase by 0% to 2%. These increases are partly attributed to higher royalties resulting from the elevated gold prices received during the quarter. The average market price of gold in Q3 stood at USD 2,474 per ounce.

- Copper Production and Cost Analysis: Barrick’s copper production in the third quarter surpassed the second quarter, primarily due to improved grades and recoveries at Lumwana. This was facilitated by enhanced ore access following the ramp-up of stripping activities in the previous quarter, with additional improvements anticipated in the fourth quarter. The cost of sales per pound of copper is expected to be 5% to 7% higher, while C1 cash costs per pound are projected to increase by 13% to 15%. However, all-in sustaining costs per pound are estimated to be 2% to 4% lower, mainly due to reduced capitalized waste stripping at Lumwana. The average market price for copper in Q3 was USD 4.18 per pound.

- Operational Highlights and Future Outlook: Barrick’s diversified portfolio continued to deliver stable performance across its key gold and copper operations. Nevada Gold Mines contributed significantly to overall gold production, with notable outputs from Carlin, Cortez, and Turquoise Ridge. Loulo-Gounkoto, Pueblo Viejo, North Mara, and Kibali also remained strong contributors. On the copper side, Lumwana was the primary driver of increased production, complemented by steady performance at Zaldívar and Jabal Sayid. Looking ahead, Barrick expects a stronger fourth quarter as operational optimizations and higher grades take effect.

- Upcoming Financial Results Announcement: Barrick will provide a more comprehensive analysis of its third-quarter performance when it releases its full quarterly financial results before North American markets open on November 7, 2024. This report will offer deeper insights into the company’s operational and financial metrics, reaffirming its commitment to achieving its 2024 production targets.

Technical Observation (on the daily chart):

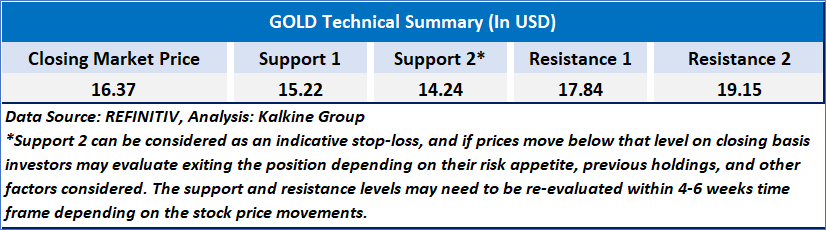

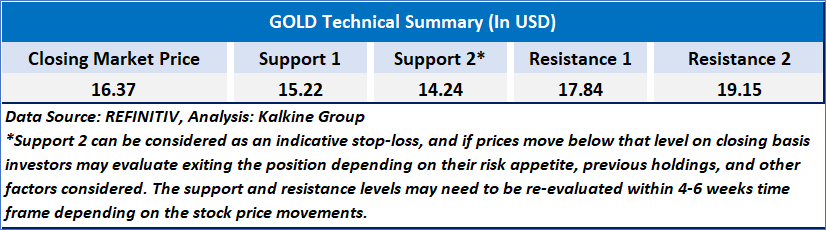

Barrick Gold Corp has been in a downtrend but is showing signs of stabilization and potential reversal. The price is above the 21-day MA (16.87) and approaching the 50-day MA (16.43), with RSI at 55 indicating moderate bullish momentum. Key resistance is at 16.87–17.00, and support at 15.87. A breakout above resistance could confirm an uptrend, while failure to hold support may lead to further downside. Watch for a potential golden cross for stronger bullish confirmation.

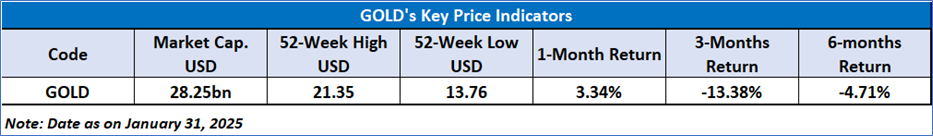

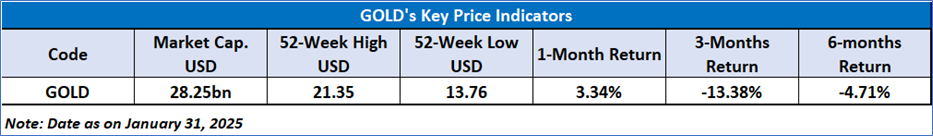

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Buy’ rating has been given to Barrick Gold Corporation (NYSE: GOLD) at the closing market price of USD 16.37 as of January 31,2025.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is January 31,2025. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...