Freeport-McMoRan Inc.

Freeport-McMoRan Inc. (NYSE: FCX) is a global mining company with geographically diverse operations and substantial reserves of copper, gold, and molybdenum. Its asset portfolio includes the Grasberg minerals district in Indonesia, known for its copper and gold deposits, as well as major mining operations in North and South America, such as the Morenci minerals district in Arizona and the Cerro Verde mine in Peru. The company’s segments encompass the Morenci, Cerro Verde, and Grasberg (Indonesia) copper mines, along with Rod & Refining operations and Atlantic Copper Smelting & Refining.

Recent Business and Financial Updates

- Strong Third-Quarter Performance: Freeport-McMoRan (FCX) demonstrated strong operating performance in the third quarter of 2024, exceeding expectations for copper and gold sales volumes. The company reported third-quarter copper and gold sales volumes surpassing their July 2024 estimates. Additionally, unit net cash costs for the third quarter were below both the July 2024 estimate and the results from the third quarter of 2023. FCX continued to focus on long-term organic growth while benefiting from favorable market fundamentals and an optimistic outlook for its business operations.

- Financial Highlights: In the third quarter of 2024, FCX posted a net income attributable to common stock of $526 million, or $0.36 per share, alongside an adjusted net income of $556 million, or $0.38 per share. These results reflect net charges of $30 million, which were primarily related to impairments for legacy oil and gas matters and nonrecurring labor-contract charges at its Cerro Verde operation. The company’s strong financial performance underscores its ability to generate healthy margins and cash flows while meeting production targets.

- Production and Sales Performance: FCX’s consolidated production in the third quarter of 2024 amounted to 1.1 billion pounds of copper, 456 thousand ounces of gold, and 20 million pounds of molybdenum. Sales volumes for the quarter reached 1.0 billion pounds of copper, 558 thousand ounces of gold, and 19 million pounds of molybdenum, exceeding the copper and gold sales projections for the period. The company’s full-year 2024 sales expectations include approximately 4.1 billion pounds of copper, 1.8 million ounces of gold, and 80 million pounds of molybdenum.

- Cost and Cash Flow Performance: FCX achieved an average unit net cash cost of $1.39 per pound of copper in the third quarter, which was lower than both its July 2024 estimate and the third-quarter 2023 performance. Operating cash flows totaled $1.9 billion for the third quarter and are expected to reach approximately $6.8 billion for the full year, factoring in the continuation of the company’s sales volumes and cost estimates. Capital expenditures for the quarter totaled $1.2 billion, with significant investments in major mining projects and PT Freeport Indonesia’s new downstream processing facilities.

- Debt and Liquidity: As of September 30, 2024, FCX’s consolidated debt amounted to $9.7 billion, with consolidated cash and cash equivalents totaling $5.0 billion. Excluding the restricted cash associated with PT Freeport Indonesia’s export proceeds, the company’s net debt stood at $0.5 billion. The company also made significant equity purchases during the quarter, increasing its ownership interest in Cerro Verde to 55.08% from 53.56%, for a total cost of $210 million.

- Operations and Expansion Projects: FCX continues to innovate within its operations, particularly in North and South America, where the company is implementing advanced technologies and data analytics to improve leaching processes. These innovations contributed 58 million pounds of copper in the third quarter of 2024. The company is also pursuing potential expansion projects at its Bagdad and Safford operations, which could significantly increase production in the coming years. The decision to proceed with these expansions will depend on market conditions, labor availability, and other factors.

- Future Outlook and Strategic Growth: Looking ahead, FCX remains focused on long-term growth opportunities, with an optimistic outlook for the copper market and its own operations. The company continues to explore avenues for future growth, including expansion projects in North America and the further development of its downstream processing capabilities in Indonesia. FCX’s strategic initiatives, coupled with a strong financial profile, position the company well to capitalize on favorable market conditions and generate continued value for shareholders.

Technical Observation (on the daily chart):

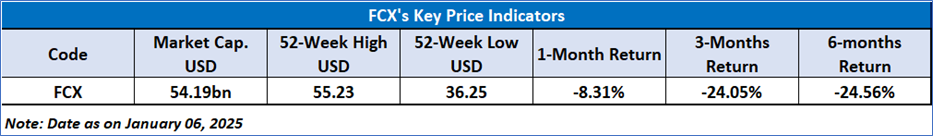

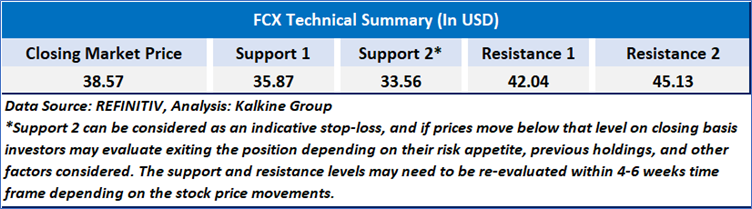

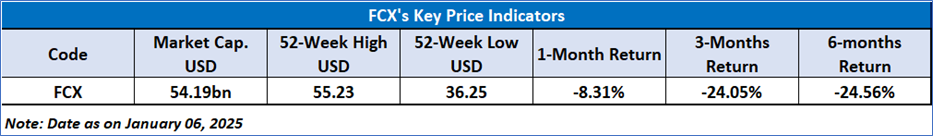

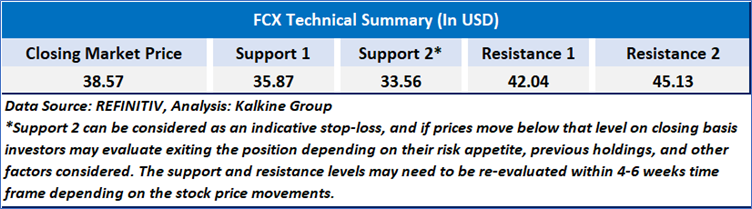

The stock of Freeport-McMoRan (FCX) is currently in a bearish trend, trading below both the 21-day and 50-day moving averages, indicating short-term and broader downtrends. The Relative Strength Index (RSI) is at 35.98, near oversold levels, suggesting a potential for reversal, though not yet oversold. A recent volume spike suggests selling pressure, and the stock is nearing support in the $36–$38 range. Resistance lies around the 21-day and 50-day moving averages. Overall, the trend is bearish, but there may be a short-term bounce if the stock holds above support levels.

Freeport-McMoRan delivered strong third-quarter 2024 results, surpassing sales expectations for copper and gold while maintaining lower-than-expected unit net cash costs. The company’s solid financial performance, with strong cash flow and capital expenditures focused on strategic growth, positions it well for future success. FCX is advancing innovative technologies, pursuing key expansion projects, and benefiting from favorable market conditions, ensuring a positive outlook and continued value generation for shareholders.

As per the above-mentioned price action, recent key business and financial updates, momentum in the stock over the last month, and technical indicators analysis, a ‘Buy’ rating has been given to Freeport-McMoRan Inc. (NYSE: FCX) at the closing market price of USD 38.57 as of January 06,2025.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is January 06,2025. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...