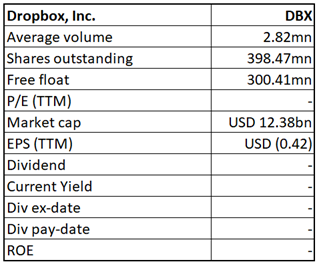

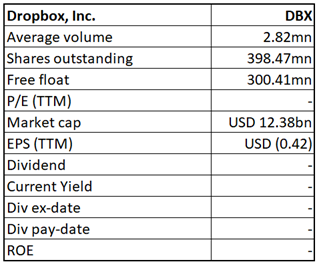

Dropbox, Inc.

DBX Details

Dropbox, Inc. (NASDAQ: DBX) is a prominent multinational collaboration platform provider. The DBX platform allows users to create, access, share, collaborate and safeguard their material. More than 700 million registered users in 180 countries utilize the DBX platform. Individuals, families, teams, and organizations pay for memberships to its platform, which produces income.

Share Repurchase Program: DBX repurchased and retired 5.5 million and 24.1 million shares of its Class A common stock for a total consideration of USD 150.8 million and USD 582.7 million during Q2FY21 and H1FY21, respectively. This comprises USD 200.0 million in repurchases of 8.6 million shares of its Class A common stock outside of its stock buyback program in conjunction with the issuance of certain 0% convertible senior notes in Q1FY21.

H1FY21 Results: The company reported a 12.99% increase in revenues to USD 1.04 billion during H1FY21 (ended June 30, 2021) compared to USD 922.4 million during H1FY20, primarily due to growth in paying users and a mix of sales towards higher-priced subscription plans. As a result, the company reported an increase in H1FY21 net income to USD 135.6 million from USD 56.8 million reported in H1FY20. As of June 30, 2021, the company had cash and cash equivalents (including short-term investments) of USD 1.94 billion, with total debt amounting to USD 1.66 billion.

Key Risks: DBX uses software and services licensed and acquired from third parties to build and deliver its platform. Therefore, any loss of the right to utilize any software or services necessary for the development and maintenance of its platform might cause delays in its delivery, which could be detrimental to the company's platform and business.

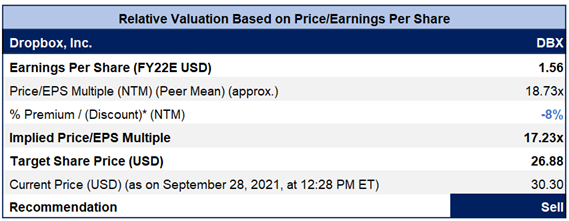

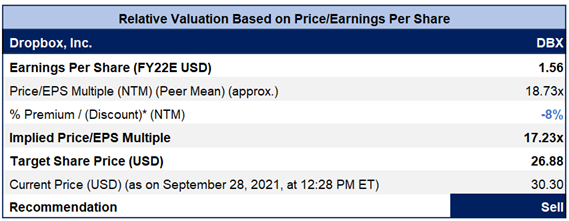

Valuation Methodology: Price/Earnings Per Share Multiple Based Relative Valuation

(Analysis by Kalkine Group)

* % Premium/(Discount) is based on our assessment of the company's NTM trading multiple after considering its key growth drivers, economic moat, stock's historical trading multiples versus peer average/median, and investment risks.

DBX Daily Technical Chart (Source: REFINITIV)

Stock Recommendation: DBX's share price has surged 57.13% in the past twelve months and is currently leaning towards the higher band of the 52-week range of USD 17.66 to USD 33.00. The stock is currently trading between its 50 and 200 DMA levels, and its RSI Index is at 42.34. We have valued the stock using the Price/Earnings-based relative valuation methodology and arrived at a target price of USD 26.88. Considering the significant uptick in the stock price, we believe the strong business fundamentals are adequately reflected at the current trading levels. Hence, we recommend a "Sell" rating on the stock at the current price of USD 30.30, down 2.49%, as of September 28, 2021, 12:28 PM ET.

*All forecasted figures and Industry Information have been taken from REFINITIV.

*The reference data in this report has been partly sourced from REFINITIV.

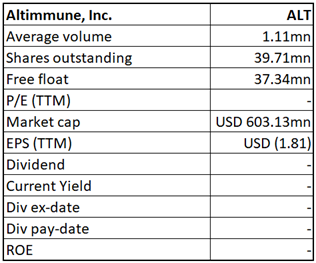

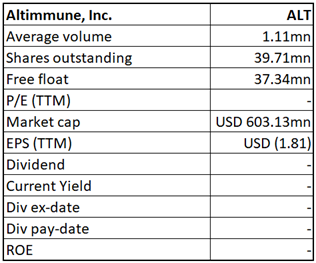

Altimmune, Inc.

ALT Details

Altimmune, Inc. (NASDAQ: ALT) is a clinical-stage biopharmaceutical firm focused on obesity and liver disease therapies. Peptide therapies for obesity, NASH (ALT-801), chronic hepatitis B (HepTcell), and intranasal therapeutics (NasoVAX, NasoShield) are among the company's pipeline projects. Due to the highly competitive COVID-19 landscape, ALT stated in June 2021 that further development of its COVID-19 vaccine candidate, AdCOVID, would be discontinued. Grant earnings from contracts with numerous research development agencies in the United States are its primary source of income.

Positive Results from Phase 1 Clinical Trials: ALT released successful phase 1 clinical study findings of Pemvidutide (proposed INN, formerly known as ALT-801) in overweight and obese volunteers on September 28, 2021. Pemvidutide was well tolerated, and no dosage titration was required. In Q4FY21, ALT expects to file a second Investigational New Drug (IND) application in the area of obesity, with a 48-week Phase 2 obesity study starting in H1FY22.

H1FY21 Results: The company reported a 66.77% decline in revenues to USD 0.98 million during H1FY21 (ended June 30, 2021) compared to USD 2.93 million during H1FY20, primarily due to the timing of clinical trials, development activities and settlement of indirect rates on the NasoShield program. As a result, the company reported an increase in H1FY21 net loss to USD 39.69 million from USD 20.65 million reported in H1FY20. As of June 30, 2021, the company has cash and cash equivalents (including short-term investments) of USD 217.83 million and no outstanding debt.

Key Risks: ALT's business is highly dependent on the success of its product candidates, notably NASH (ALT-801), chronic hepatitis B (HepTcell) and intranasal therapeutics, which still require significant research and development (R&D) processes before seeking regulatory approval and launching commercial sales. If these products fail in clinical development, do not receive regulatory approval, or are not successfully commercialized, the company's business will be adversely affected.

Outlook: ALT announced in its Q2FY21 earnings release that the submission of IND application for ALT-801 for non-alcoholic steatohepatitis (NASH) is on track for Q3FY21, to be followed by a clinical trial in non-alcoholic fatty liver disease (NAFLD). It further noted that another IND application for the clinical trial in obesity would be submitted in Q4FY21, with phase 2 of the trial anticipated to commence in H1FY22.

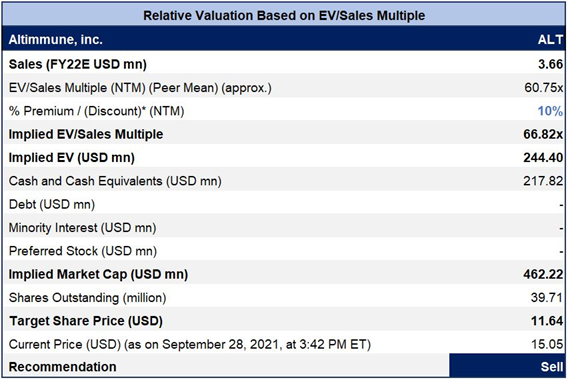

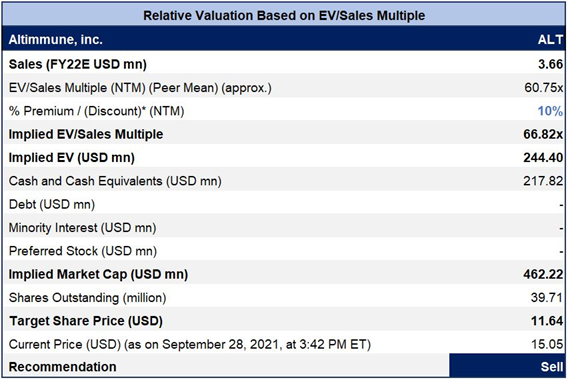

Valuation Methodology: EV/Sales Multiple Based Relative Valuation

(Analysis by Kalkine Group)

* % Premium/(Discount) is based on our assessment of the company's NTM trading multiple after considering its key growth drivers, economic moat, stock's historical trading multiples versus peer average/median, and investment risks.

ALT Daily Technical Chart (Source: REFINITIV)

Stock Recommendation: ALT's stock price surged 36.77% in the past nine months and is currently leaning towards the lower end of the 52-week range of USD 7.80 to USD 24.61. The stock is currently trading above its 50 and 200 DMA levels, and its RSI Index is at 52.67. We have valued the stock using the EV/Sales-based relative valuation methodology and arrived at a target price of USD 11.64. Considering the significant uptick in the stock price in the past nine months and loss-making history, we believe the decent business fundamentals are sufficiently reflected at the current trading levels. Hence, we recommend a "Sell" rating on the stock at the current price of USD 15.05, down 0.92% as of September 28, 2021, 3:42 PM ET.

* All forecasted figures and Industry Information have been taken from REFINITIV.

*The reference data in this report has been partly sourced from REFINITIV.

Disclaimer - This report has been issued by Kalkine Pty Limited (ABN 34 154 808 312) (Australian financial services licence number 425376) (“Kalkine”) and prepared by Kalkine and its related bodies corporate authorised to provide general financial product advice. Kalkine.com.au and associated pages are published by Kalkine.

Any advice provided in this report is general advice only and does not take into account your objectives, financial situation or needs. You should therefore consider whether the advice is appropriate to your objectives, financial situation and needs before acting upon it.

There may be a Product Disclosure Statement, Information Statement or other offer document for the securities or other financial products referred to in Kalkine reports. You should obtain a copy of the relevant Product Disclosure Statement, Information Statement or offer document and consider the statement or document before making any decision about whether to acquire the security or product.

You should also seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice in this report or on the Kalkine website. Not all investments are appropriate for all people.

The information in this report and on the Kalkine website has been prepared from a wide variety of sources, which Kalkine, to the best of its knowledge and belief, considers accurate. Kalkine has made every effort to ensure the reliability of information contained in its reports, newsletters and websites. All information represents our views at the date of publication and may change without notice.

Kalkine does not guarantee the performance of, or returns on, any investment. To the extent permitted by law, Kalkine excludes all liability for any loss or damage arising from the use of this report, the Kalkine website and any information published on the Kalkine website (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Kalkine hereby limits its liability, to the extent permitted by law, to the resupply of services.

Please also read our Terms & Conditions and Financial Services Guide for further information.

On the date of publishing this report (referred to on the Kalkine website), employees and/or associates of Kalkine and its related entities do not hold interests in any of the securities or other financial products covered on the Kalkine website.

Kalkine Media Pty Ltd, an affiliate of Kalkine Pty Ltd, may have received, or be entitled to receive, financial consideration in connection with providing information about certain entity(s) covered on its website.

AU

Please wait processing your request...

Please wait processing your request...