Nokia Oyj

Nokia Oyj (NYSE: NOK) is a Finland-based company engaged in the network and Internet protocol (IP) infrastructure, software, and related services market. The Company's businesses include Nokia Networks and Nokia Technologies. The Company's segments include Ultra Broadband Networks, IP Networks and Applications, and Nokia Technologies.

Recent Business and Financial Updates

- Nokia Corporation’s Financial Calendar for 2025: Nokia Corporation has released its financial calendar for 2025, outlining the planned publication dates for its financial reports. The company will announce its Q4 and full-year 2024 results on 30 January 2025, followed by interim reports for Q1 on 24 April, Q2 and half-year results on 24 July, and Q3 on 23 October. Additionally, Nokia intends to publish its "Nokia in 2024" annual report—which includes the Board of Directors' review and audited financial statements—during the week of 10 March 2025. The Annual General Meeting (AGM) is scheduled for 29 April 2025.

- Global 5G Deployment: Nokia has secured numerous 5G deals around the world, particularly in the US and China, positioning it well in the ongoing 5G rollout. The company reported 319 commercial 5G deals with communications service providers globally, with 110 live networks.

- Multi-Year, Multi-Billion Dollar Extension with Bharti Airtel in India: Nokia secured a significant deal in November 2024 with Bharti Airtel, one of India's largest telecom operators, to extend their 4G and 5G deployment across key Indian cities and states. This agreement is aimed at preparing for the 5G-Advanced network evolution. It involves deploying Nokia's cutting-edge AirScale portfolio, including base stations, baseband units, and Massive MIMO radios, all powered by Nokia's energy-efficient ReefShark technology.

- Agreement with T-Mobile in the USA: Nokia continues its long-standing partnership with T-Mobile, securing a five-year deal to expand T-Mobile's nationwide 5G network with Nokia's industry-leading 5G RAN solutions. This contract not only ensures Nokia's leadership in the US 5G market but also involves deploying its enhanced C-Band portfolio to support T-Mobile's network expansion, which is crucial for providing high-speed 5G services across the nation.

- Private 5G Network Contracts: Nokia reported signing 30 new private networking contracts in Q2 2024, focusing on enterprise solutions. These deals span across various sectors, providing tailored 5G networks for businesses that require high reliability, low latency, and secure connections.

- Technological Leadership: Nokia has reached a significant milestone of 7,000 patent families declared essential to 5G, reinforcing its leadership in cellular innovation. Built on over EUR150 billion in R&D investments since 2000, Nokia's patented technologies are fundamental to smartphones, connected vehicles, IoT devices, and more, with over 250 companies licensing them. With its strong patent portfolio and ongoing pre-standardization efforts, Nokia is also well-positioned for the upcoming 6G standardization.

- Multi-User MIMO (MU-MIMO): MU-MIMO is fundamental for enhancing 5G network performance, enabling better data rates and spectral efficiency, which are key selling points for 5G services.

- Massive MIMO: Nokia has patents related to Massive MIMO, where many antennas are used at the base station to serve multiple users with high precision beamforming. This technology boosts cell capacity and user throughput, crucial for dense urban environments where 5G needs to handle high data demands efficiently.

- 5G NR (New Radio) Standardization: Nokia holds numerous patents related to the standardization of 5G NR, including aspects like frame structure, modulation schemes, and channel coding. These patents ensure that Nokia's technology is integral to the 5G network's core functionality, making it indispensable for any company looking to deploy 5G services compliant with global standards.

- Financial Performance:

- Strong Financial Performance and Margin Improvements: Nokia demonstrated resilience in Q3 2024 despite market challenges, achieving a significant improvement in its gross margin, which increased by 490 basis points year-over-year to 45.7%. The company’s comparable operating margin rose by 160 basis points to 10.5%, driven by cost control measures and enhanced product and regional mix. Although net sales declined by 7% in constant currency due to weaker demand in India and a divestment in Cloud and Network Services, Network Infrastructure showed strong order intake, with Fixed Networks and IP Networks growing by 9% and 6%, respectively. Nokia’s cost savings program delivered EUR 500 million in gross savings, contributing to stable profitability. The company remains optimistic about future growth, with a full-year comparable operating profit outlook of EUR 2.3 to 2.9 billion and free cash flow conversion expectations at the high end of its 30% to 60% target.

- Strategic Growth and Shareholder Returns: Nokia continues to invest in growth opportunities beyond traditional telecom markets, with a strong focus on expanding in data centers, private wireless networks, and the defense sector. The company’s pending acquisition of Infinera, valued at USD 1.7 billion, is expected to strengthen its Optical Networks portfolio and accelerate market expansion. Additionally, Nokia remains committed to shareholder value through a dividend distribution of EUR 0.03 per share and an accelerated EUR 600 million share buyback program. Looking ahead, the company anticipates a significant acceleration in Network Infrastructure growth in Q4 and sees structural demand trends supporting long-term expansion. Despite near-term sales recovery occurring slower than expected, Nokia’s improving gross margin, disciplined pricing strategy, and continued cost optimization reinforce its strong competitive positioning.

- Strategic Moves:

- Strategic Acquisitions for Market Expansion: Nokia's acquisition of Infinera for around USD 2.3 billion in June 2024 demonstrates its strategic intent to strengthen its optical-networks business. By absorbing Infinera's expertise in photonic integrated circuits, digital signal processors, and silicon photonics, Nokia not only expands its market share in North America, where Infinera has a strong presence, but also enhances its technological offerings. This move is expected to drive significant synergies, aiming for EUR 200 million in net comparable operating profit by 2027, thereby positioning Nokia to achieve double-digit operating margins in its optical segment, crucial for long-term growth.

- Partnerships for Technological Innovation: Nokia's partnership with Google Cloud, announced in 2023, is another strategic move to innovate within the 5G landscape. This collaboration focuses on developing 5G applications on Google's cloud infrastructure, targeting areas like network slicing and edge computing. By combining Nokia's network expertise with Google's cloud capabilities, the partnership aims to create cloud-native solutions that meet the demands of low latency and high reliability, essential for modern applications. This initiative not only diversifies Nokia's service portfolio but also opens new revenue streams in the cloud-integrated networking market, positioning Nokia at the forefront of 5G technology innovation.

- Market Dynamics:

- Market Dynamics: Competitive Advantage: The geopolitical landscape has significantly altered the competitive environment within the 5G telecom sector, particularly with the rise of tensions between Western countries and China, impacting companies like Huawei. Nokia has capitalized on this shift by becoming a preferred choice for 5G infrastructure in countries where there are restrictions or concerns about using Chinese technology. For example, in the United States, Nokia has secured substantial contracts with major carriers like T-Mobile and AT&T following the U.S. government's ban on new equipment from Huawei and ZTE for security reasons. Similarly, in Europe, countries like the UK have set deadlines to remove Huawei equipment from 5G networks, giving Nokia opportunities to replace this infrastructure. This geopolitical advantage allows Nokia to expand its market share in regions where trust in Western technology providers is paramount, enhancing its competitive positioning.

- Market Dynamics: Industry Tailwinds: The telecom industry is currently in the midst of a significant upgrade cycle, transitioning from 4G to 5G networks, which has created favorable conditions for companies like Nokia. This cycle is driven by the need for faster data speeds, lower latency, and increased network capacity to support burgeoning technologies such as IoT, autonomous vehicles, and smart cities. Nokia is well-positioned to capitalize on these industry tailwinds through its comprehensive 5G portfolio. For instance, Nokia's deal with Bharti Airtel in India to extend 4G and deploy 5G networks across key regions exemplifies how it can leverage this industry trend. Another example is Nokia's partnership with Deutsche Telekom for the rollout of 5G services in Germany, where the demand for advanced telecom infrastructure is high due to the country's push towards digital transformation. This industry momentum not only increases Nokia's current business opportunities but also sets the stage for long-term growth as 5G networks continue to scale globally.

- Investor Sentiment and Analyst Views:

- Analyst Upgrades: The sentiment around Nokia's stock has been notably positive in recent financial analyses, with several analysts revising their price targets upwards. This reflects a growing confidence in Nokia's strategic direction and its market potential in the 5G landscape. For instance, analysts from firms like TipRanks have set an average price target for Nokia at around USD 5.86, which represents a significant upside from current levels. This optimism is often based on Nokia's successful deal acquisitions, its strong patent portfolio, and its robust performance in key markets. Morgan Stanley, for example, upgraded Nokia to an "overweight" rating, citing the company's potential in the 5G rollout phase and its competitive edge in optical networking post the Infinera acquisition.

- Market Recovery: The broader market dynamics, including a recovery in the tech and telecom sectors, have played a significant role in boosting Nokia's share price. After a period of volatility, the tech sector has seen a resurgence, driven by investor interest in growth stocks with solid fundamentals, especially in areas like 5G, where Nokia is a key player. This recovery is evidenced by the performance of tech indices and the return of investor confidence in digital transformation technologies. Nokia, with its advancements in 5G technology, strategic partnerships, and a focus on operational efficiency, has been part of this upward movement.

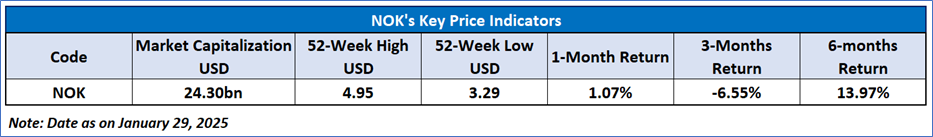

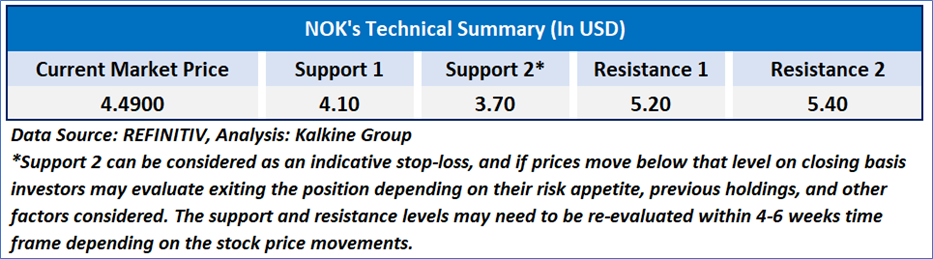

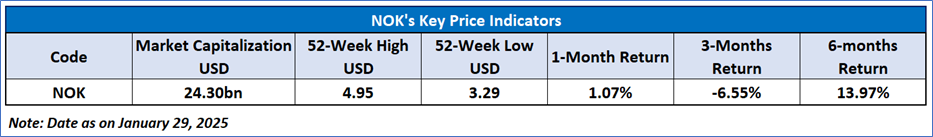

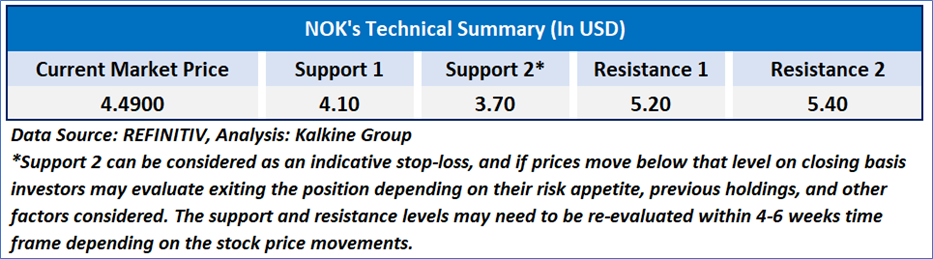

Technical Observation (on the daily chart):

The Relative Strength Index (RSI) over a 14-day period stands at a value of 48.77, currently near mid-levels, with expectations of a consolidation or upward momentum if USD 4.00-USD 4.50 support levels hold. Additionally, the stock's current positioning is above both the 50-period SMA and 200-period SMA, which may serve as dynamic short to medium-term support levels.

Individuals can evaluate the stock based on the support and resistance levels provided in the report in case of keen interest taking into consideration the risk-reward scenario.

Markets are trading in a highly volatile zone currently due to certain macro-economic issues and prevailing geopolitical tensions. Therefore, it is prudent to follow a cautious approach while investing.

Related Risk: This report may be looked at from a high-risk perspective and a recommendation is provided for a short duration. This report is solely based on technical parameters, and the fundamental performance of the stocks has not been considered in the decision-making process. Other factors which could impact the stock prices include market risks, regulatory risks, interest rates risks, currency risks, social and political instability risks etc.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference date for all price data, currency, technical indicators, support, and resistance level is January 29, 2025. The reference data in this report has been partly sourced from REFINITIV.

Note 3: Investment decisions should be made depending on an individual's appetite for upside potential, risks, holding duration, and any previous holdings. An 'Exit' from the stock can be considered if the Target Price mentioned as per the Valuation and or the technical levels provided has been achieved and is subject to the factors discussed above.

Note 4: Target Price refers to a price level that the stock is expected to reach as per the relative valuation method and or technical analysis taking into consideration both short-term and long-term scenarios.

Note 5: ‘Kalkine reports are prepared based on the stock prices captured either from the New York Stock Exchange (NYSE), NASDAQ Capital Markets (NASDAQ), and or REFINITIV. Typically, all sources (NYSE, NASDAQ, or REFINITIV) may reflect stock prices with a delay which could be a lag of 15-20 minutes. There can be no assurance that future results or events will be consistent with the information provided in the report. The information is subject to change without any prior notice.

AU

Please wait processing your request...

Please wait processing your request...